Bad loans

Bad loans

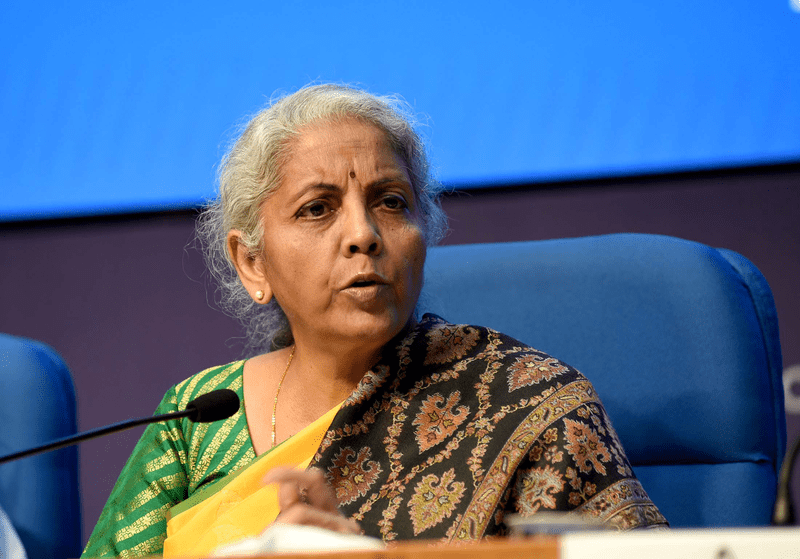

Public sector banks recovered 14% of written-off loans in last 5 years: FM Sitharaman

New Delhi: Public sector banks could get back only 14 percent of the written-off loans in the last five years ending March 2022, Parliament was informed on Tuesday.

In a written reply to the Rajya Sabha, Finance Minister Nirmala Sitharaman said of the total written-off loans worth Rs 7.34 lakh crore, government-run banks recovered Rs 1.03 lakh crore.

In the past five years, the net written-off amount reached Rs 6.31 lakh crore following the recovery process, she said.

In response to a separate inquiry, the Finance Minister clarified that non-performing assets (NPAs), which include those that have been fully provisioned after four years, are removed from a bank's balance sheet through a write-off process in accordance with the guidelines issued by the RBI and the policy approved by bank boards.

Banks evaluate/consider the impact of write-offs as part of their regular exercise to clean up their balance sheets, avail tax benefits and optimise capital, in accordance with RBI guidelines and policy approved by their boards, she said.

Such write-off does not result in waiver of liabilities of borrowers to repay, she said.

The finance minister stated that even though loans are written-off, borrowers are still responsible for repayment and the recovery process for outstanding payments from borrowers with written-off loans is still ongoing. As a result, the borrower does not benefit from the write-off process.

Banks will continue to take steps to collect outstanding payments in written-off accounts using a variety of recovery mechanisms, such as filing civil suits or acting under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, or via Debts Recovery Tribunals.

The finance minister further added that banks also seek to recover outstanding payments by taking legal action in the National Company Law Tribunal under the Insolvency and Bankruptcy Code, 2016, negotiating settlements or compromises, and selling non-performing assets.

Additionally, in response to another question, the finance minister stated that the Department of Personnel & Training is responsible for creating and implementing reservation policies for Scheduled Castes (SCs), Scheduled Tribes (STs), and Other Backward Classes (OBCs) in service and posts under the Central Government.

According to Sitharaman, the policies and guidelines framed by the Department of Personnel & Training for reservation in services and posts under the Central Government for SCs, STs, and OBCs are also applicable to Public Sector Banks, Public Sector Insurance Companies, and Public Financial Institutions (PSBs/PSICs & PFIs).

The Board of Directors of these institutions is responsible for the implementation of these policies and guidelines, as they function as independent entities within the broader framework of government guidelines. The Board of Directors is also responsible for protecting and representing various categories of employees as per statutory provisions.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.