Govt expected to receive $2 billion in dividends from PSBs in next fiscal year

New Delhi: The public sector banks are reporting substantial profits and are likely to produce $2 billion in dividends for the next financial year, starting on April 1, media reports said.

Public sector banks recovered 14% of written-off loans in last 5 years: FM Sitharaman

New Delhi: Public sector banks could get back only 14 percent of the written-off loans in the last five years ending March 2022, Parliament was informed on Tuesday.

Pvt banks top PSBs in total credit share

New Delhi/IBNS: The private banks in the country have disbursed more credit than their state-owned peers in the second quarter ended September 2022, increasing their share to 38.4 percent from 37.5 a year ago, according to an RBI report.

Mumbai: The Reserve Bank of India (RBI) has issued a clarification over a bulleting article written by its researchers that said "a big bang approach to privatise them will do more harm than good" given the important role played by them in financial inclusion.

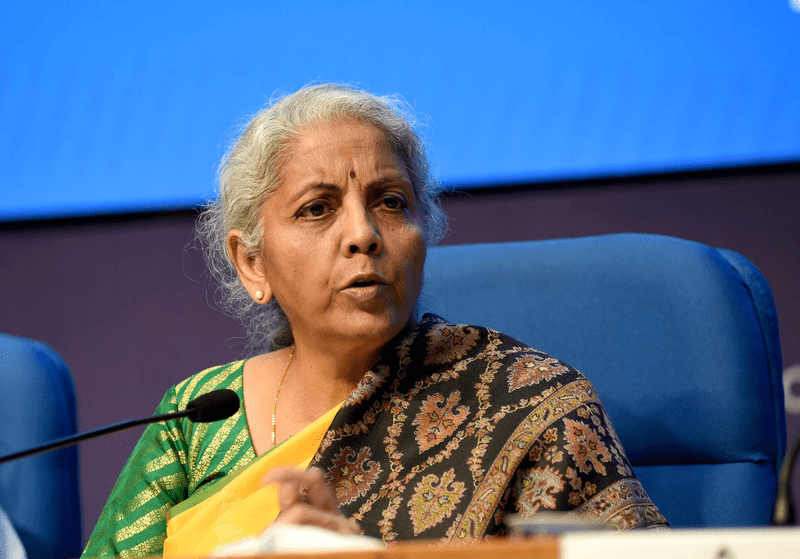

FM Sitharaman to hold meeting with PSB heads

New Delhi: Finance Minister Nirmala Sitharaman will meet the heads of public sector banks (PSBs) on April 23 to review the performance of banks and the progress made by them on the various government schemes.

Recovery by PSBs as percentage of NPAs improves to 14.69% in FY2019-20

New Delhi: As per Reserve Bank of India (RBI) data, the recovery made by public sector banks (PSBs) during the financial year as a percentage of gross non-performing assets (NPAs) as on beginning of the financial year (FY) has improved from 11.33 percent in FY2017-18, to 13.52 percent in FY2018-19, to 14.69 percent in FY2019-20.

Bank privatisation is nothing but just a political agenda, says former Andhra MLC Nageshwar

Hyderabad/UNI: Former Andhra Pradesh MLC, Dr Prof K Nageshwar said the privatisation of banks by the Central government is nothing but just a political agenda and insisted on creating more awareness among the public around the dire need to save Public Sector Banks (PSBS) from the political influence and privatisation in order to safeguard 'People’s money for People’s welfare'.

Not all banks will be privatised, assures Nirmala Sitharaman

New Delhi: Union Finance Minister Nirmala Sitharaman on Tuesday assured that merging of banks or privatisation of financial institutions will not hurt the interest of the employees.

Indian Govt to reduce public sector banks from 12 to 5 : Report

New Delhi/IBNS: The Indian government has decided to privatise more than half of public sector banks to reduce their number to just four or five, a Reuters report said.

Public Sector Banks proposed to be provided Rs 70,000 crore capital to boost credit

New Delhi, July 5 (IBNS): Public Sector Banks are to be further provided Rs 70,000 crore capital to boost credit for a strong impetus to the economy. To further improve ease of living, they will leverage technology, offering online personal loans and doorstep banking, and enabling customers of one Public Sector Bank to access services across all Public Sector Banks.

Union government asks PSBs to consolidate overseas operations

New Delhi, Mar 2 (IBNS): The Union government has asked Public Sector Banks (PSBs) to consolidate 35 overseas operations, according to media reports.