April 29, 2024 02:07 (IST)

Union Budget 2016: Incentives for start-ups as they can generate employment

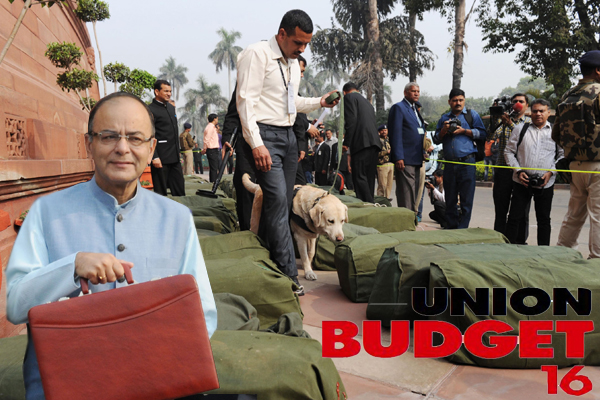

New Delhi, Feb 29 (IBNS) Union Finance Minister Arun Jaitley while presenting the Union Budget 2016 on Monday said that start-ups generate employment, bring innovation and are expected to be key partners in the Make in India programme.

He has proposed 100% deduction of profits for 3 out of 5 years for start-ups set-up from April 2016 to March 2019. MAT will apply in such cases.

However, capital gains tax will not be applied if invested in regulated/notified Fund of Funds and by individuals in notified start-ups, in which they hold majority shares.

Jaitley also proposed a special patent regime with 10% rate of tax on income from worldwide exploitation of patents developed and registered in India.

To get more investment in Asset Reconstruction Companies (ARCs), the Union Finance Minister proposed to provide a complete pass through of income-tax to securitization trusts including trusts of ARCs. He said that the income will be taxed in the hands of investors instead of the trust. However, the trust will be liable to deduct tax at source.

The period for getting benefit of long-term capital gain in case of unlisted companies was proposed to be reduced from three to two years.

The minister said that non-banking financial companies shall be eligible for deduction to the extent of 5% of their income in respect of provision for bad and doubtful debts. He reiterated the commitment to implement GAAR from 1.4.2017.

The minister also informed that to meet the commitment to BEPS initiative of OECD and G-20, the Finance Bill, 2016 includes provision for requirement of country by country reporting for companies with a consolidated revenue of more than Euro 750 million.

He further proposed to exempt service tax on services provided under Deen Dayal Upadhyay Grameen Kaushalya Yojana and services provided by Assessing Bodies empanelled by Ministry of Skill Development & Entrepreneurship.

He proposed to exempt service tax on general insurance services provided under ‘Niramya’ Health Insurance Scheme launched by National Trust for the Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disability.

Jaitley also proposed to extend nil basic customs duty to Braille paper.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.

Support objective journalism for a small contribution.

Latest Headlines

Goa Shipyard Limited signs MoU with Netherlands-based Damen Shipyards in field of e-Tugs Sun, Apr 28 2024

After postponing visit to India, Tesla CEO Elon Musk heads to China Sun, Apr 28 2024

AdaniConneX sets benchmark with construction financing framework of USD 1.44 billion Sun, Apr 28 2024

India’s export of premium-quality basmati rice up 22% till Feb 2024 Sat, Apr 27 2024

Small Finance Banks can now apply to become universal banks under the on-tap licesning norms: RBI Sat, Apr 27 2024

Difference Between Demat and Trading Account Fri, Apr 26 2024

SBI Cards Q4FY24 net profit grows 11% YoY to Rs 662.37 cr Fri, Apr 26 2024

Stock market opens in green with Nifty near 22,600 Fri, Apr 26 2024