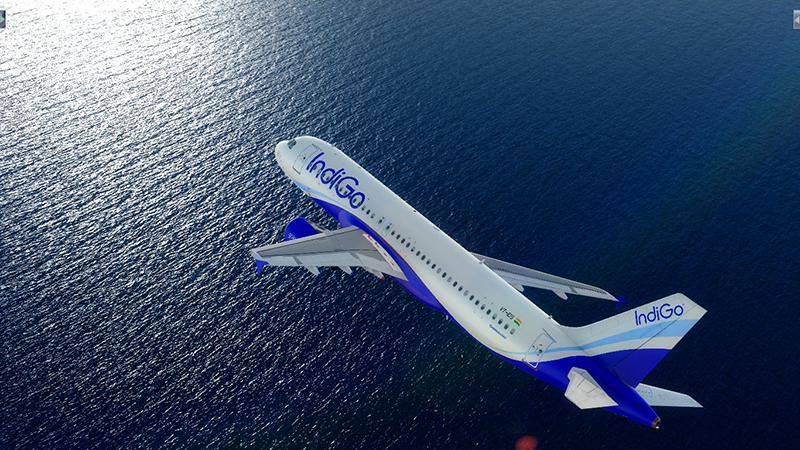

IndiGo denies report on buying majority stake in troubled Go First airline

Gurugram: InterGlobe Aviation Ltd which operates India’s largest airline IndiGo has refused to answer queries over news reports that it is trying to buy a majority stake in troubled carrier Go First.

Earlier media reported that IndiGo is moving in the direction to buy a stake in low-cost carrier Go First, controlled by the Wadia Group.

Financially challenged Go First had sought initiation of voluntary insolvency proceedings and imposition of an interim moratorium under the Insolvency and Bankruptcy Code (IBC) in May.

"IndiGo is aware about certain media reports stating that IndiGo has expressed an interest in Go First. IndiGo does not comment on market speculation and remains focussed on its growth strategy," an IndiGo official told CNBC TV18 on Thursday.

The report by a Gujrati daily had said IndiGo is considering merging its operations with GoFirst and several rounds of talks have taken place.

As per the report, the merger and acquisition could take up to five years. IndiGo, India’s largest airline in terms of market share and fleet size, holds nearly 70 percent of the Indian market.

In its last Q4 results, IndiGo announced a profit of Rs 919 crore, reflecting a significant increase of 76.5 percent in revenue.

Go First, in its bankruptcy filing submitted to the National Company Law Tribunal (NCLT), has disclosed that it has outstanding debts amounting to Rs 6,521 crore ($797.38 million) owed to Bank of Baroda, IDBI Bank, and Deutsche Bank.

The airline has said that its total liabilities stand at approx. Rs 11,463 crore to various entities such as banks, other creditors, vendors, and others.

On May 10, the NCLT granted Go First bankruptcy protection and appointed Abhilash Lal as the Insolvency Resolution Professional (IRP) responsible for overseeing the airline's operations.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.