GST

GST

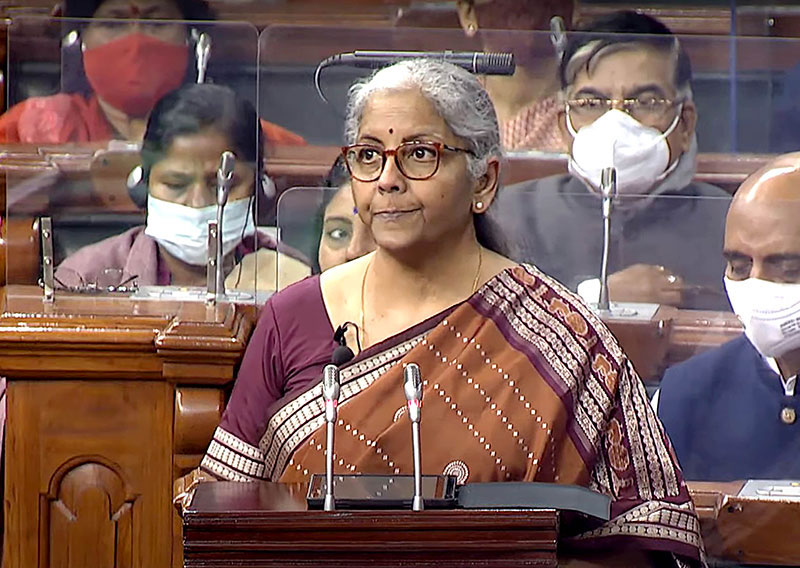

21,791 fake GST registrations, tax evasion of over Rs 24,000 cr uncovered: Sitharaman

New Delhi: GST officers have identified 21,791 fraudulent GST registrations and uncovered potential tax evasion exceeding Rs 24,000 crore during a two-month-long special drive, Finance Minister Nirmala Sitharaman on Tuesday said.

In a written reply to a query in the Rajya Sabha, the minister underscored the officers are periodically instructed to exercise prudence and care when exercising powers like summons, provisional property attachment, and tax credit blocking to protect the interests of honest taxpayers and prevent undue hardship.

"A total of 21,791 entities (11,392 entities pertaining to state tax jurisdiction and 10,399 entities pertaining to CBIC jurisdiction) having GST registration were discovered to be non-existent. An amount of Rs 24,010 crore (state - Rs 8,805 crore + Centre - Rs 15,205 crore) of suspected tax evasion was detected during the special drive," Sitharaman said.

In response to a query regarding the number of fake registrations and the total amount of tax evasions, the minister addressed the specific timeframe of the special operation against fraudulent GST registrations led by the Central Board of Indirect Taxes and Customs (CBIC) conducted from May 16 to July 15, 2023.

In response to a question about the government's acknowledgment of the difficulties encountered by e-commerce businesses in acquiring GST registrations, particularly those functioning in virtual realms, Sitharaman stated that given the unique features of e-commerce operators, an efficient registration process for them has already been officially communicated and implemented.

GST Rules have been amended to enhance the registration process, incorporating biometric-based Aadhaar authentication for high-risk registrants and verification of original document copies.

The pilot project, initiated in Gujarat and later extended to Puducherry and Andhra Pradesh, tests this system.

Registered entities must provide bank account details, name, and PAN within 30 days of registration or before filing the outward supply statement, whichever comes first.

Failure to do so results in automatic system suspension, but compliance leads to automatic reactivation.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.