Union government mulling various incentives for Indian start ups

New Delhi, Apr 12 (IBNS): The Union Ministry of Commerce & Industry announced on Thursday that the Department of Industrial Policy and Promotion (DIPP) has issued a gazette notification regarding the constitution of a broad based Inter-Ministerial Board (IMB) to consider applications of Startups for claim certain incentives under the Income Tax Act 1961 (Act).

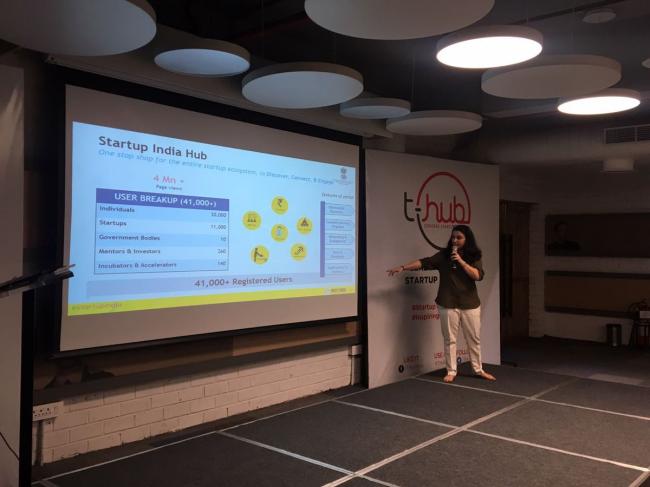

The Central government launched the ‘Startup India’ initiative on January 16, 2016, to build a strong eco-system for nurturing innovation and entrepreneurship.

The incentives include:

Exemption from levy of income tax on share premium received by eligible Startups under section 56 of the Act -- 100 per cent deduction of the profits and gains from income of Startups for three out of seven consecutive assessment years under 80 IAC of the Act.

Applications for certification of startups under section 56 and Section 80 IAC of the Act will be submitted through an online portal to DIPP. These applications will be considered by IMB for certification.

For the purposes of section 56 of the Act, there is no restriction on class of investors and eligible startups can receive investment from any person against issue of share capital.

DIPP has been holding regular stakeholder consultations including those with government ministries/ departments, regulators, angel investors and startups.

Amendments introduced through this notification are meant to address key demand of startups with regard to exemptions under the Income Tax Act, 1961.

With the introduction of amendments through this notification, according to the government release, startups are likely to have easy access to funding, which in turn will ensure ease in starting of new businesses, promote startup eco-system, encourage entrepreneurship leading to more job creation and economic growth in the country.

Image: StartupIndia/Twitter

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.