Trump’s proposed bill could slap 5% tax on US remittances, hitting Indian workers hardest

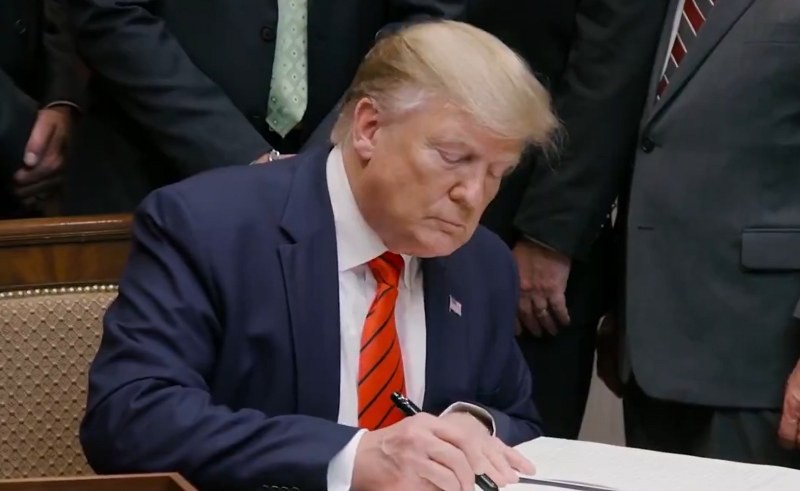

Washington DC: US President Donald Trump’s proposed legislation — the “One Big Beautiful Bill Act” — is raising alarm among Indian professionals in America due to a controversial clause that seeks to tax cross-border remittances.

While the bill is pitched as a sweeping reform combining tax breaks, reduced public expenditure, and tighter border control, it also outlines a 5% levy on all outward remittance transactions, with few exceptions.

The proposed tax could particularly hit Indian workers in the US, who currently contribute the largest share of remittances to India.

As per the Reserve Bank of India’s sixth edition of the Remittances Survey, the US accounted for 27.7% of the total inflows into India in 2023-24, overtaking traditional leaders in the Gulf region like the UAE, which contributed 19.2%.

India received a record $118.7 billion in remittances during the financial year — a vital source of foreign exchange.

The bill mandates that the 5% tax be collected by the remittance service provider — typically a US bank — at the time of the transaction.

These institutions would then be required to deposit the collected taxes on a quarterly basis with the US Treasury.

Moreover, banks and money transfer agents would carry secondary liability in case the tax isn’t collected at the time of transfer.

The only exemption proposed is for verified US citizens and nationals, who would be designated as “Qualified remittance transfer providers” upon formal registration through an agreement with the US Treasury.

Notably, the exemption isn’t based on transaction size or amount — meaning even low-value transfers by non-citizens could incur the tax.

This could directly affect a large chunk of Indian expatriates, especially those on temporary work visas like H-1B and L-1.

Between October 2022 and September 2023, over 70% of all H-1B visas issued were granted to Indian professionals, according to figures presented in the Rajya Sabha.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.