More than 300 Canadians named in Paradise Papers linked to tax havens

Ottawa, Nov 6 (IBNS): More than 300 Canadians whose names are present in Paradise Papers, described as the largest leak of financial data, are suspected to have used offshore tax havens to evade taxes, media reports said.

The figure is around 3,300.

The revelation comes from “ParadisePapers”, as the documents are being called by a collective of international journalists who after months of ferreting a clutch of records and internal communications from Bermuda's Appleby and Singapore's Asiaciti presented their findings night.ParadisePapers refer to a trove - 13.4 million files - of financial data leaked from two firms on Sunday

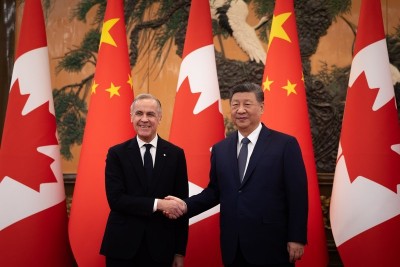

The reports have shown that Canada is Applyby's one of the biggest markets after the U.S., the U.K. and China.

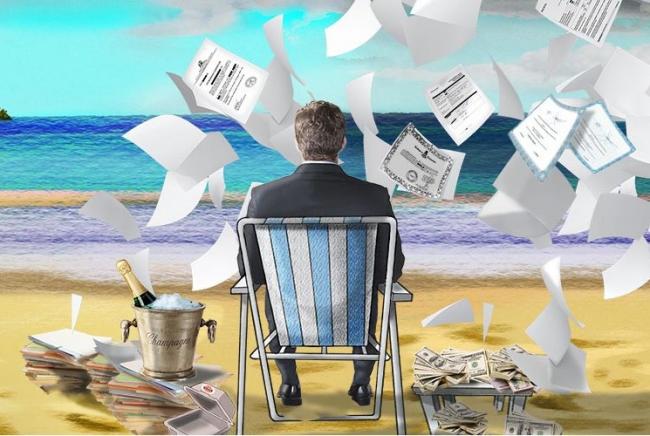

The data has brought number of Canadian firms and individuals under the scanner who have paid very little or almost no tax as they have received the benefits from the offshore trusts and corporations which are set up in countries.

Canadian supermarket giant, Loblaw, issued a statement that reads: "the CRA is aware of all of our international income. Our activities [...] are legal and transparent."

It is said that Bermuda firm Appleby and Singapore-based Asiaciti helped the ultra-rich & powerful move money abroad

Appleby allegedly helped clients set up offshore firms and manage bank accounts to evade taxes, manage realty, buy planes and yachts, move tonnes of money across the globe.

Apart from the U.K., the U.S. and China, several Indians have also been named in Paradise Papers.

The list of Indian names include 714 big Indians, including corporate heavyweights, politicians and entertainment leaders, are among the global behemoths.

(Reporting by Souvik Ghosh)

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.