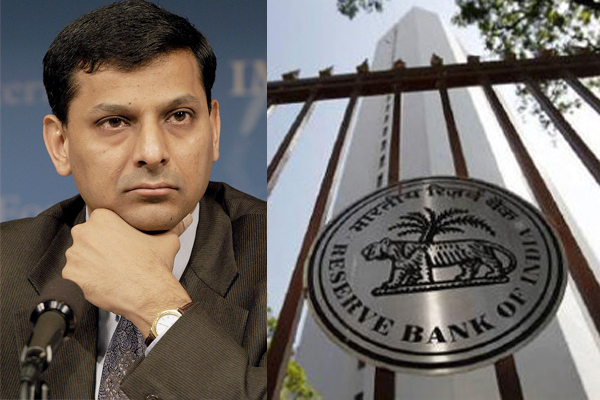

RBI cuts key rates to boost economy

Presenting its second Bi-monthly Monetary Policy Statement, 2015-16, RBI Governor Dr. Raghuram G. Rajan said on the basis of an assessment of the current and evolving macroeconomic situation, it has been decided to reduce the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points from 7.5 per cent to 7.25 per cent with immediate effect.

He said there are mixed signs of economic recovery and risk to inflation remains still.

The RBI also kept the cash reserve ratio (CRR) of scheduled banks unchanged at 4.0 per cent of net demand and time liabilities (NDTL);

continue to provide liquidity under overnight repos at 0.25 per cent of bank-wise NDTL at the LAF repo rate and liquidity under 14-day term repos as well as longer term repos of up to 0.75 per cent of NDTL of the banking system through auctions; and continue with overnight/term variable rate repos and reverse repos to smooth liquidity.

Consequently, the reverse repo rate under the LAF stands adjusted to 6.25 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 8.25 per cent.

RBI said investment still remains weak.

Banks should pass on the rate cuts to consumers, said the RBI governor.

RBI said since the first bi-monthly monetary policy statement of 2015-16 issued in April 2015, incoming data suggest that the global recovery is still slow and getting increasingly differentiated across regions.

In the United States, the economy shrank in Q1 owing to harsh weather conditions, the strength of the US dollar weighing on exports and a decline in non-residential fixed investment. In the euro area, financial conditions have eased due to the European Central Bank’s (ECB) quantitative easing and a depreciating euro.

There has, however, been some moderation in composite purchasing managers’ indices (PMI), economic sentiment and consumer confidence in April.

In Japan, growth surprised on the upside in Q1, supported by private demand as business spending boosted inventories and personal consumption. For most emerging market economies (EMEs), macroeconomic conditions remain challenging due to domestic fragilities, exacerbated by bouts of financial market turbulence. China continues to decelerate in spite of monetary easing.

The third bi-monthly monetary policy statement will be announced on August 4, 2015.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.