Mahindra Finance

Mahindra Finance

Mahindra Finance launches Special Deposit Schemes for digitally affluent customers

New Delhi: Mahindra Financial Services Limited (Mahindra Finance), part of the Mahindra Group, a non-banking finance company focused on rural and semi-urban sector, on Wednesday announced the launch of a Special Deposit Scheme.

This scheme, aimed specifically for digitally affluent customers is part of the company’s Digitisation drive.

In keeping with today’s digital world, depositors have an opportunity to interact directly with the deposit taking companies for placement of deposits.

To leverage this opportunity, Mahindra Finance is announcing an innovative scheme that will offer 20 bps higher interest rates per annum on direct deposits.

This scheme is in addition to prevailing deposit schemes which the company is already offering to its customers.

Vivek Karve, Chief Financial Officer, Mahindra Finance said: “The launch of this special deposit schemes is in accordance with our larger vision of offering multiple financial/ investment instruments through digital mode. Mahindra Finance’s fixed deposit schemes are FAAA rated by CRISIL, the credit rating that indicates Highest Safety”.

The company will offer this Special Deposit Schemes through digital mode to depositors via the company website https://www.mahindrafinance.com/ for investment. With various digitised and automation backend processes, Mahindra Finance is confident of providing a seamless experience to its deposit holders.

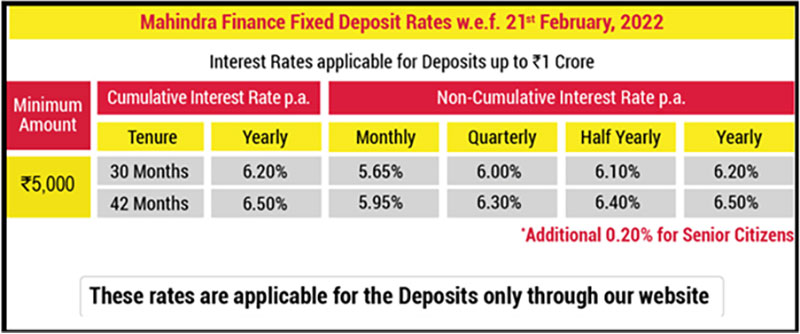

Under these schemes, the depositors can place their deposits for a tenure of 30 and 42 months, which will carry 6.20% and 6.50% interest rate respectively.

Both cumulative and non-cumulative options are available for depositors to choose from.

Further, senior citizens shall be eligible for another 20 bps higher rates.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.