India’s top 500 private firms worth $3.8 trillion, surpassing 2023 GDP

New Delhi: The combined valuation of India’s 500 most valuable non-state-run companies stood at Rs 324 trillion ($3.8 trillion) in 2024, surpassing the country’s estimated 2023 gross domestic product (GDP) of $3.5 trillion, according to a report released by Axis Bank’s Burgundy Private and Hurun India.

The 2024 Burgundy Private Hurun India 500 companies saw a 40% surge in cumulative value, exceeding not only India’s GDP but also the combined GDPs of the UAE, Indonesia, and Spain.

The threshold to qualify for the list rose to Rs 9,580 crore, a 43% increase from Rs 6,700 crore last year.

Notably, for the first time since the list’s inception, every company on it is valued at least $1 billion, despite the rupee’s depreciation.

“The companies from 2024 Burgundy Private Hurun India 500 make up the ‘backbone’ of India's private sector, wielding significant economic influence. Between them, they have a cumulative valuation of US$3.8 trillion, which is higher than India's annual GDP, and employ 8.4 million people. If you want to understand how the Indian economy is developing, understanding the stories behind 2024 Burgundy Private Hurun India 500, India's most valuable companies, is a great place to start,” said Anas Rahman Junaid, Founder and Chief Researcher, Hurun India.

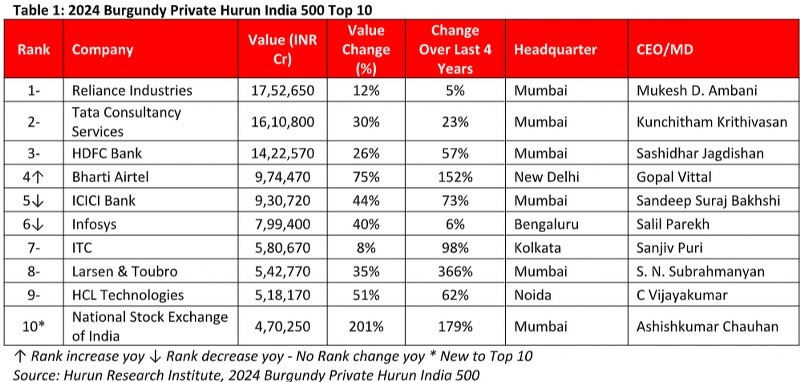

Mukesh Ambani-led Reliance Industries Ltd. (RIL) retained its position as India’s most valuable company with a valuation of Rs 17.5 trillion, up 12%.

Tata Consultancy Services (TCS) followed at Rs 16.1 trillion, up 30%, while HDFC Bank ranked third at Rs 14.2 trillion, up 26%.

Among the top gainers, Motilal Oswal Financial Services led the list as the fastest-growing company, with its value surging 297% year-on-year, followed by Inox Wind and Zepto, both of which nearly tripled their valuations.

Interestingly, nearly 60% of the companies in the Burgundy Private Hurun India 500 do not appear in the Fortune India 500, which ranks companies by revenue.

The Hurun 500 prioritizes future profit potential over current sales.

"The list does not include state-owned enterprises, so India's most valuable state-owned listed company, State Bank of India (SBI), worth about Rs 7.7 trillion, is not on the list. Well over 100 Indian state-owned companies could have made our list, both listed companies and non-listed companies, such as LIC, NTPC, ONGC, etc.," the release stated.

New entrants in the top 10

For the first time, Bharti Airtel entered the top five with a valuation of Rs 9.74 trillion, a 75% jump, climbing two spots.

The National Stock Exchange (NSE) also made its debut in the top 10, valued at Rs 4.7 trillion.

"The NSE surged by 201% in value to Rs 4.7 trillion, overtaking SII to become India’s most valued unlisted company. Logistics startup Zepto (269%), the National Stock Exchange (201%), and Physics Wallah (172%) recorded the highest percentage growth among unlisted firms," the release noted.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.