GST

GST

'Wait for true GST 2.0 continues': Congress on Modi govt's major overhauling of tax structure

New Delhi/IBNS: The Congress has provided a mixed response to the central government's major overhauling of the GST regime, which now has two main slabs instead of the previous four, media reports said.

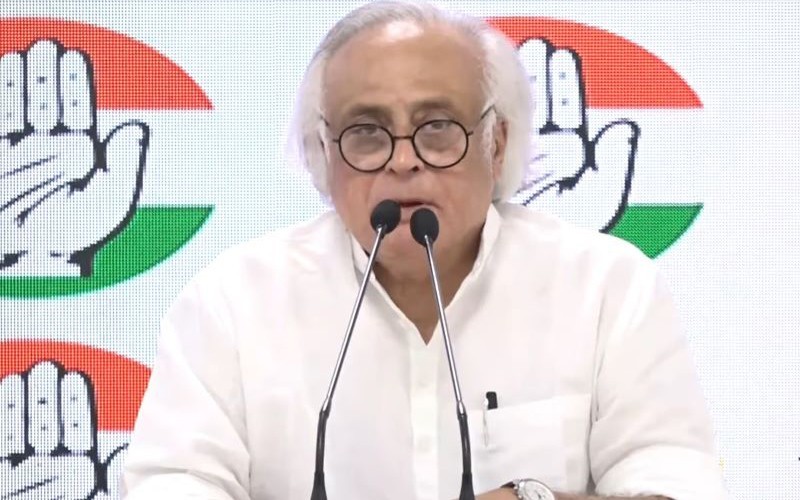

Congress general secretary Jairam Ramesh slammed the Modi government over the previous four slabs of GST.

Ramesh said the Congress had referred to the flawed GST 1.0 way back in 2017 but Prime Minister Narendra Modi allegedly did not pay attention to it.

He has also questioned the functionality of the GST Council as the skeleton of the new regime was spelled out by the Prime Minister during his Independence Day address on August 15.

Ramesh's X post reads, "The Indian National Congress has for long been advocating for a GST 2.0 that reduces the number of rates, cuts the rates on a large number of items of mass consumption, minimises evasion, mis-classification, and disputes, does away with inverted duty structure (lower tax on output as compared to inputs), eases the compliance burden on MSMEs, and expands GST coverage.

"The Union Finance Minister has made major announcements last evening after the meeting of the GST Council, which is a constitutional body. However, even before the GST Council meeting, the Prime Minister had already proclaimed the substance of its decisions in his Independence Day speech of August 15th, 2025. Is the GST Council to be reduced to a formality?"

He added, "Faced with a lack of buoyancy in private consumption, subdued rates of private investment, and endless classification disputes, the Union Finance Minister has finally recognised that GST 1.0 had reached a dead end. In fact, the very design of GST 1.0 was flawed and this had been pointed out by the INC way back in July 2017 itself, when the PM had made one of his typical U turns and decided to introduce GST. It was meant to be a Good and Simple Tax. It turned out to be a Growth Supressing Tax.

"Last evening’s announcements have certainly made headlines since the PM had already laid down the pre-Diwali deadlines. Presumably the benefits of rate cuts will be passed on to consumers. However the wait for a true GST 2.0 continues. Whether this new GST 1.5, if it can be called that, stimulates private investment - especially in manufacturing - remains to be seen. Whether this will ease the burden on MSMEs, time alone will tell. Meanwhile one key demand of the states made in the true spirit of cooperative federalism — namely, the extension of compensation for another five years to fully protect their revenues— remains unaddressed. In fact, that demand assumes even greater importance now."

Union Finance minister Nirmala Sitharaman announced sweeping rate cuts after the GST Council approved a new two-slab structure of 5% and 18%. An additional slab of 40 percent has been kept for sin goods, sugary products and super luxury items.

The decisions were taken at the 56th GST Council meeting held on Wednesday, which reviewed rate revisions and category adjustments across a wide range of products under the indirect tax system.

The reforms, set to take effect from September 22, are expected to significantly lower household expenses.

"For common man and middle class items, there is a complete reduction from 18% and 12% to 5%. Items such as hair oil, toilet, soap bars, soap bars, shampoos, toothbrushes, toothpaste, bicycles, tableware, kitchenware and other household articles are now at 5%," Sitharaman said.

"UHT milk, paneer, all the Indian breads will see nil rate," she added.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.