Inflation

Inflation

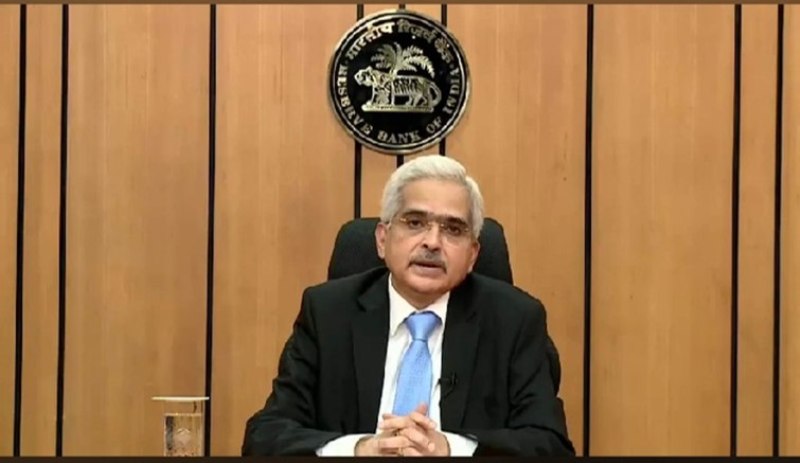

'RBI committed to bringing inflation down to 4 pc': Shaktikanta Das

New Delhi: Reserve Bank of India (RBI) Governor Shaktikanta Das Saturday said there is no need to increase the inflation target from 2 to 3 percent even as the Central bank has failed to keep it below the 6 percent upper tolerance level for nine consecutive months, according to media reports.

Das expressed confidence that the October print will be less than 7 percent.

The Reserve Bank of India (RBI) Act mandates that if the inflation target remains above the upper tolerance level for three quarters at a stretch, the central bank has to submit a report to the government, detailing the reasons and laying out the remedial measures it will be taking to check the price rise.

RBI's Monetary Policy Committee (MPC) has already met this month to finalise the report explaining the reasons for missing the inflation target for three quarters.

As per a notification issued on March 31, 2021, the central government retained the inflation target at 4 percent (with the upper tolerance level of 6 percent and the lower tolerance level of 2 percent) for the five-year period April 1, 2021 to March 31, 2026.

Retail inflation in September increased to 7.4 percent from 7 percent in August on higher food and energy costs.

"We expect the October number which will be released on Monday to be lower than 7 percent. Inflation is a matter of concern with which we are now dealing and dealing effectively," Das was quoted as saying by a report in the media.

Inflation above 6 percent for India would be detrimental to growth and stall the flow of international investment into the country. It would hurt financial savings and the investment climate, he said.

The inflation band of 2-6 percent allows RBI enough policy space to utilise during times of stress, as was done during the COVID-19 pandemic, he said.

Instead of shifting the goalpost, the RBI remains committed to bringing inflation down to 4 percent over a period of time, he underscored.

In the last six to seven months, the government and the RBI have taken a number of measures to check price rise, Das said.

He maintained that India will continue to be the fastest-growing major economy with a likely growth rate of 7 percent in 2022-23 owing to strong macroeconomic fundamentals and financial sector stability.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.