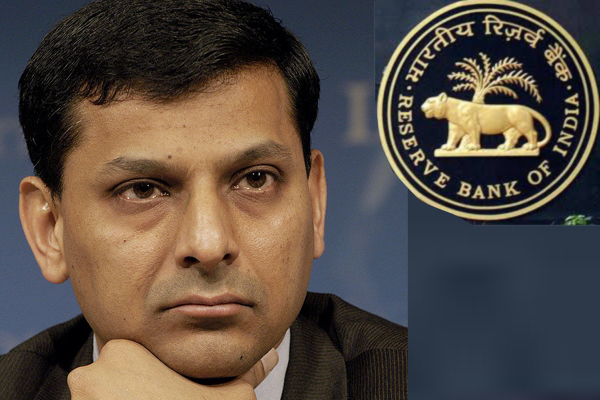

In his last policy meet RBI Governor Raghuram Rajan maintains status quo

He kept the key policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.5 per cent.

Similarly, the cash reserve ratio (CRR) of scheduled banks has been kept unchanged at 4.0 per cent of net demand and time liabilities (NDTL).

"As you will note from the policy statement, we have kept rates on hold, maintaining an accommodative stance while we await developments.We are within the inflation band given to us by the Government and expect to be around 5 per cent CPI inflation by March 2017..., " he said in a statement.

“It is appropriate for the Reserve Bank to keep the policy repo rate unchanged at this juncture, while awaiting space for policy action. The stance of monetary policy remains accommodative and will continue to emphasise the adequate provision of liquidity,” Rajan said.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.