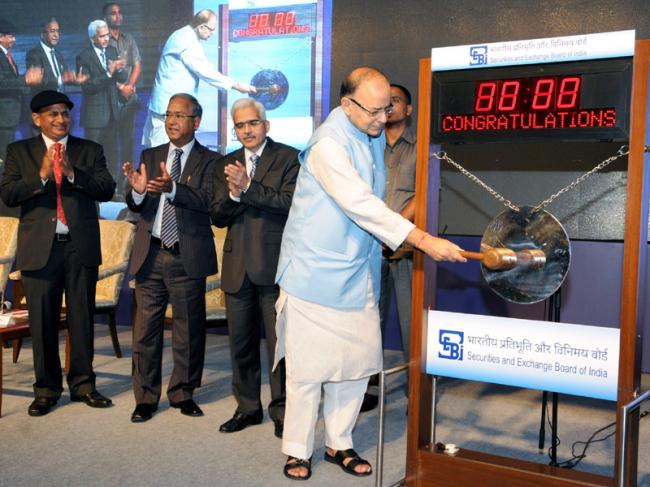

Finance Minister Arun Jaitley formalizes merger of FMC with SEBI

The Union Finance Minister Arun Jaitley formalized the merger by ringing the Customary Bell in Mumbai.

Speaking on the occasion, the Finance Minister said that amalgamation of FMC and SEBI would bring convergence of regulations in the commodities and equity derivatives markets.

Jaitley said, “The merger will increase the economies of scope and scale as there are strong commonalities between all kinds of trading. I am sure that SEBI is prepared to regulate the commodity derivatives market”.

The Finance Minister said that markets thrive where there is confidence and integrity and this requires transparency and good regulations.

Jaitley said, “Market participants and regulators have to brace themselves to face the challenges thrown by global developments and integration of markets”.

The Finance Minister Shri Jaitley further said that the regulator must ensure that manipulative activities are curbed in this market.

He further cautioned that since the physical market for commodities was widespread, fragmented and unregulated for certain goods, SEBI needs to have a proper mechanism to capture any aberrations in the physical market that would disrupt the derivatives market.

He said that farmers, producers and consumers need to have confidence that derivatives market is free from manipulations and market abuses.

“It would be a challenge for SEBI because this is an additional responsibility, but SEBI has matured over the last two decades to take on such responsibilities,” the Finance Minister said.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.