March 07, 2026 05:43 am (IST)

Economic Survey 2015-16 projects strong macroeconomic outlook for India

New Delhi (IBNS) Union finance minister, Arun Jaitley, while presenting The Economic Survey 2015-16 to the Parliament on Friday said the survey testifies a strong macroeconomic outlook for the country.

He said, the Survey shows that a pick-up in growth in some large advanced economies along with lower global commodity prices and relative financial stability amidst periodic turbulence marked the external sector environment in 2015-16.

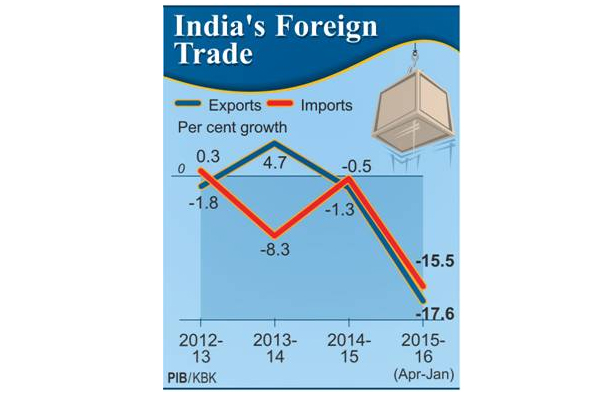

According to the Survey, during the current financial year (April-January), the growth in India’s exports declined year on year by 17.6% and they stood at 217.7 billion US dollars.

Imports have also declined by 15.5% in the current financial year (April-January) to 324.5 billion US dollars, largely due to a decline in Petroleum Oil Lubricants (POL) imports so far.

As a result, during 2015-16 (April-January) trade deficit decreased to 106.8 billion US dollars as compared to 119.6 billion US dollars in the corresponding period of 2014-15.

The Economic Survey further says that while exports slow down may continue for a while before picking up in the next fiscal, continuance of low commodity prices globally augurs well for sustaining low trade and current account deficit. As a portion of GDP, the Current Account Deficit (CAD) is likely to be in the low range of One to One Point Five percent. Moderate growth in the invisibles surplus, coupled with lower trade deficit, resulted in lower CAD of US $ 26.8 billion (1.3 per cent of GDP) in 2014-15 and US $ 14.4 billion (1.4 per cent of GDP) in first half of 2015-16.

India’s Balance of Payments (BoP) position remained comfortable during the first half of 2015-16. Low levels of CAD coupled with moderate rise in capital inflows resulted in rise in foreign exchange reserves of 10.6 billion US dollars in first half of 2015-16. India’s foreign exchange reserves at 351.5 billion US dollars as Feb 5, 2016, mainly comprised foreign currency assets equal to 328.4 billion US dollars (93.4% of the total) and Gold at 17.7 billion US dollars. With increase in reserves in 2015-16 (H1), all traditional reserve-based external sector vulnerability indicators have improved. The reserves cover for imports increased from 8.9 months at end-March 2015 to 9.8 months at end-September 2015.

During 2015-16 (April-January), the average exchange rate of the rupee depreciated to Rs. 65.04 per US dollar as compared to Rs. 60.92 per US dollar in 2014-15 (April- January).

India’s external debt has remained in safe limits as shown by the external debt to GDP ratio of 23.7% and debt service ratio of 7.5% in 2014-15. The prudent external debt policy of the Government of India has resulted in external debt remaining within safe and comfortable limits and in containing its rise.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.

Support objective journalism for a small contribution.

Latest Headlines

Mahindra's BE 6 Batman edition returns, check out the price

Fri, Mar 06 2026

Premium Finnish chocolates could soon hit Indian stores via Reliance. All details inside

Fri, Mar 06 2026

Major push: Tata Power collaborates with Salesforce to accelerate India’s clean energy transition

Fri, Mar 06 2026

Defence stock on fire! Mazagon Dock Shipbuilders Limited jumps 8% as massive Rs 99,000 crore deal nears approval

Fri, Mar 06 2026