Better tax payer services key to direct tax reforms: Jaitley

He said that the tax payers have a right to know the deductions made from their salary/income on regular basis.

He said that more and more tax payer services have to be provided in order to make the people tax complaint.

Jaitley stressed on the Government’s commitment towards continuously upgrading tax payer services.

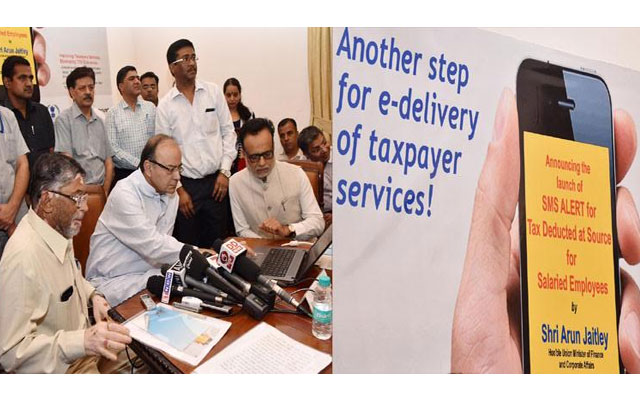

Jaitley was speaking after launching the SMS Alert Service for direct taxes for about 2.5 crore private and Government salaried employees at a function in the national capital here today.

The new step is an effort by the Income Tax Department to directly communicate deposit of tax deducted, through SMS alerts to salaried taxpayers, at the end of every quarter. In case of a mismatch, they can contact their deductor for necessary correction.

Simultaneously, SMS alerts will also be sent to deductors who have either failed to deposit taxes deducted or to e-file their TDS returns by the due date.

This initiative will initially benefit approximately 2.5 crore salaried cases. The CBDT will soon extend this facility to another 4.4 crore non-salaried taxpayers.

The frequency of SMS alerts will be increased, once the process for filing TDS returns is streamlined to receive such information on a real-time basis.

All taxpayers who wish to receive such SMS alerts are advised to update their mobile numbers in their e-filing account.

The CBDT constantly endeavours to provide better taxpayer services and reduce taxpayer grievances. New schemes and e-initiatives to redress and reduce complaints of mismatches in tax deducted at source are key to this effort.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.