Adani Wilmar

Adani Wilmar

Adani Wilmar Ltd Q4 FY23 PAT drops 60% y-o-y to Rs 94 cr, volume grows 15%; FY23 revenue grows 7% to Rs 58,185 cr

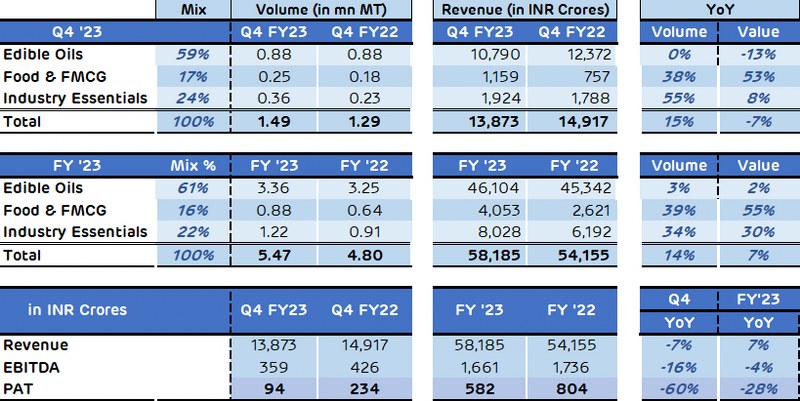

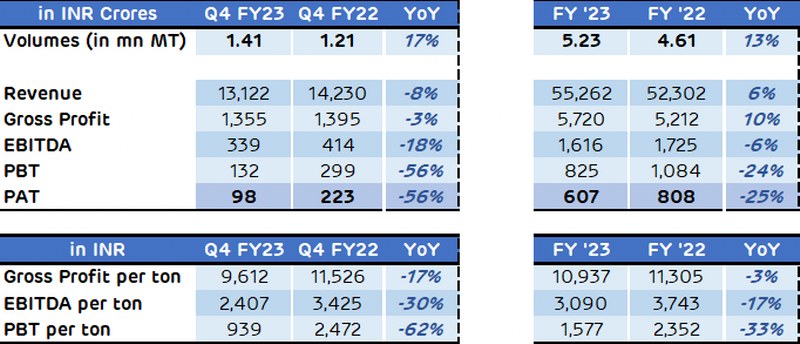

Mumbai: Adani Wilmar Ltd on Wednesday said it recorded a 15% volume growth in Q4 FY23 while consolidated revenue witnessed a decline of 7% to Rs 13,873 crore, due to a fall in prices of edible oil.

Consolidated PAT for Q4 FY23 stood at Rs 94 crore, down 60% compared to Rs 234 crore in Q4 FY22. Its EBITDA for the period stood at Rs 359 crore, 16% lower than Rs 426 crore in Q4FY22.

In FY23, the company recorded a 14% growth in volume and a 7% growth in revenue for the year at Rs 58,185 crore. Profit After Tax for the period stood at Rs 582 crore, down 28% against Rs 804 crore in FY22.

Adani Wilmar's FY23 EBITDA came at Rs 1,661 crore, down 4% compared to Rs 1,736 crore in FY22.

In the last financial year, Adani Wilmar crossed 5 million Metric Tonnes of sales.

It closed the financial year, the company doubled its revenue in 2 years with approx. Rs 4,000 crores of revenue in the Food & FMCG segment, registering a strong growth of 39% YoY in volumes and 55% YoY in revenue terms, while seeding multiple new avenues of growth during the year.

Both wheat flour and rice businesses crossed Rs 1,000 crore in revenue in FY23 In edible oil, branded segment, with nearly 75% saliency, grew by almost 8% YoY in FY’23.

Overall segment volume grew by 3% YoY during the year oleochemicals volume grew by 20% in FY’23

Adani Wilmar continued to be the highest exporter of castor oil from India in FY23

The company has crossed the milestone of 5 million Metric Tonnes of sales in FY23, enabled by scaling up of select products, and having a large addressable market, across the country, Adani Wilmar said.

It has over the years built robust infrastructure and efficient systems to support this kind of size and pace of growth, it added.

“Now, Adani Wilmar is aiming to replicate the playbook of its edible oils business in the Foods business as well. During the year, the company made good progress and has been gaining market share across food products,” read a statement from the company.

Adani Wilmar said its fourth-quarter profitability has been impacted by several factors. One of the main reasons behind the decline in profitability was the disparity in TRQ which led to pressure on Soybean oil margins.

The decline in edible oil prices continued in Q4, resulting in high-cost inventory, along with the MTM impact in P&L.

However, the impact was minimized to a large extent due to the company's robust risk management processes.

Another significant factor that impacted profitability was the inflation on costs, including packaging costs, logistics, chemicals, and power & fuel costs at the EBITDA level.

Furthermore, interest expenses went up with the increase in benchmark rates due to the hike in the Fed rates.

The base effect also played a role in the decline in profitability. In the base quarter, Q4 FY22, the company got better margins in Sunflower and other soft oils due to the bullishness in the market after the start of the Ukraine conflict.

Adani Wilmar's wholly-owned subsidiary in Bangladesh made a loss of Rs 12 crore in Q4 and Rs 63 crore in FY23 due to price caps by the government on edible oils, local currency-related issues, and unavailability of the counterparty for forex hedging. This has resulted in lower consolidated PAT, compared to the standalone PAT.

Further, Adani Wilmar stock has been included in NIFTY Next 50 Index from 31 March 2023.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.