ULI

ULI

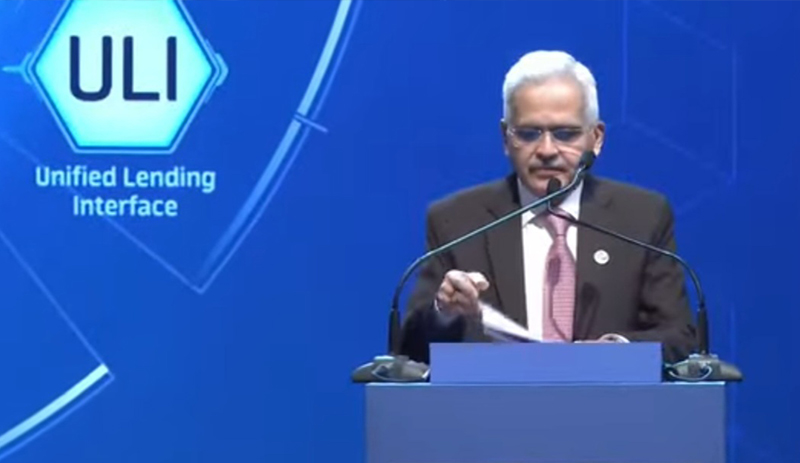

RBI Gov Shaktikanta Das unveils Unified Lending Interface, or ULI, says it will transform India's lending ecosystem

Bengaluru/IBNS: The Governor of Reserve Bank of India (RBI), Shaktikanta Das, on Monday (August 26) announced that the central bank will introduce its ‘Unified Lending Interface’, or ULI, technology platform across the nation.

He said the platform, which was introduced as a pilot project last year, aims to provide “frictionless credit” and will soon be available nationwide.

Speaking at the Global Conference on Digital Public Infrastructure and Emerging Technologies in Bengaluru, RBI Governor Shaktikanta Das said, “Just like UPI transformed the payments ecosystem, we expect that ULI will play a similar role in transforming the lending space in India."

"The ‘new trinity’ of JAM-UPI-ULI will be a revolutionary step forward in India's digital infrastructure journey,” Das said.

According to reports, the ULI platform is designed to streamline and simplify the credit appraisal process, particularly for small and rural borrowers.

By enabling the seamless and consent-based flow of digital information—including land records from various states—between data service providers and lenders, the platform significantly reduces the time required for credit approvals, reports ANI.

The RBI governor explained that the ULI architecture features common and standardised APIs, enabling a ‘plug-and-play approach.

This design reduces the complexity of integrating multiple technical systems, allowing borrowers to benefit from quicker access to credit with minimal documentation, Shaktikanta Das continued.

“By digitising access to both financial and non-financial data that traditionally existed in separate silos, ULI is expected to address the substantial unmet demand for credit across various sectors, particularly for agricultural and MSME borrowers,” Das said, as quoted by ANI.

Highlighting the success of the Unified Payment Interface, or UPI, the RBI governor noted, "The current ecosystem of digital payments in India offers a bouquet of simple, safe, and secure options for instant or quick transfer of funds, both large and small value, for businesses and individuals."

Emphasising the RBI's ongoing efforts to secure and strengthen the financial system, Shaktikanta Das said, “We are constantly working on devising policies, approaches, systems, and platforms that will make our financial sector stronger, nimble, and customer-centric."

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.