Submit Form 15G or Form 15H to avoid TDS on your Interest Income

It is mandatory for financial institutions to deduct TDS (Tax Deducted at Source) on interest income on investments exceeding Rs.10,000, or Rs.5,000, if you have a company FD. This limit has been extended to Rs.50,000 for senior citizens. Typically, the financial institutions deduct this tax, and you can adjust is later when filing your income tax returns or paying your tax amount.

Income Tax Department issues Revised Income Tax Informants Reward Scheme, 2018

New Delhi, Jun 2 (IBNS): The Income Tax Department has issued a Revised Income Tax Informants Reward Scheme, 2018, according to Union Finance Ministry on Friday.

Here's Why You Should Estimate Your Income Tax Liability for The A.Y. 2018-19

Who wants to pay the taxman? Although the tax money will lead to better social and public-sector facilities, no one wants to pay an additional penny towards the tax. Going by the logic that the government taxes our income to direct funds for infrastructure development of the country, we should ideally pay tax. Therefore, we discuss in detail the income tax liability of every salaried individual.

25% growth in number of Income Tax returns filing this year, says govt

New Delhi, Aug 7 (IBNS): As a result of demonetization and Operation Clean Money, there is a substantial increase in the number of Income Tax Returns(ITRs) filed, the government said on Monday.

Last date for IT returns extended to Aug five

New Delhi, Jul 31 (IBNS) : The Income Tax Department has extended by five days the last date for filing of income tax returns (ITRs) for the financial year 2016-17, reports said.

FM launches a new tax payer service module ‘Aaykar Setu’

New Delhi, July 10 (IBNS): A new tax payer service module ‘Aaykar Setu’, was launched here today by Union Finance Minister Arun Jaitley.

Aadhar now must for filing tax returns, new PAN from next month

New Delhi, June 10 (IBNS): In a significant move, the government on Friday said that Aadhaar will be needed for filing Income Tax Returns or for obtaining a new PAN from July 1.

Adhaar becomes mandatory for IT returns and applying for PAN

New Delhi, Mar 21 (IBNS): Adhaar card would be mandatory for filing Income Tax returns and applying for PAN from July onwards, as the government decided on Tuesday.

Budget 2017: Benefits announced for NPS subscribers

New Delhi, Feb 2 (IBNS): The Finance Bill 2017 laid down in the Parliament on Thursday introduced several new benefits for National Pension System (NPS) subscribers.

Budget 2017: Anti-graft and rationalisation measures announced in the field of income tax

New Delhi, Feb 1 (IBNS): The present burden of taxation is mainly on honest tax payers and salaried employees who are showing their income correctly, said Union Minister for Finance and Corporate Affairs Arun Jaitley while presenting the General Budget 2017-18 in Parliament on Wednesday.

Income Tax: PAN or Form-60 now mandatory for all money transactions

Kolkata, Jan 23 (IBNS): Senior officers from the Directorate of Income Tax Intelligence and Criminal Investigation said at a conference in Kolkata that the latest Income Tax amendments now make it mandatory to quote a PAN number or Form-60 for every financial transaction.

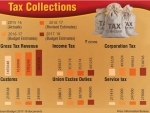

Indirect, direct tax collection up despite demonetisation says Finance Minister Arun Jaitley

New Delhi, Jan 9 (IBNS): Union Finance Arun Jaitley said on Monday that indirect and direct tax collection has gone up during the first three quarters of the current fiscal despite demonetisation in November, according to media reports.

Govt keen to weed out black money says IT director

Kolkata, Jan 3 (IBNS): At a recent seminar on the Pradhan Mantri Garib Kalyan Yojana, Additional Director of Income Tax, Intelligence and Criminal Investigation, P. B. Pramanik said the government has adopted a strict stance in its war against black money.

-1485158297.jpg)