Mumbai/IBNS: The Budget of 2023 continues from the earlier budgets which successfully guided India during one of the toughest periods for mankind, with a continued focus on Aatmanirbhar Bharat and Amrit Kaal, said BSE MD & CEO Sundararaman Ramamurthy reacting to the Budget.

Jamshedpur/IBNS: Lauding the government’s increased focus on the development of capital infrastructure, Tata Steel CEO & MD T. V. Narendran called the Budget a “high-quality budget”.

Budget 2023 reactions: Indian biz sector says budget will push growth

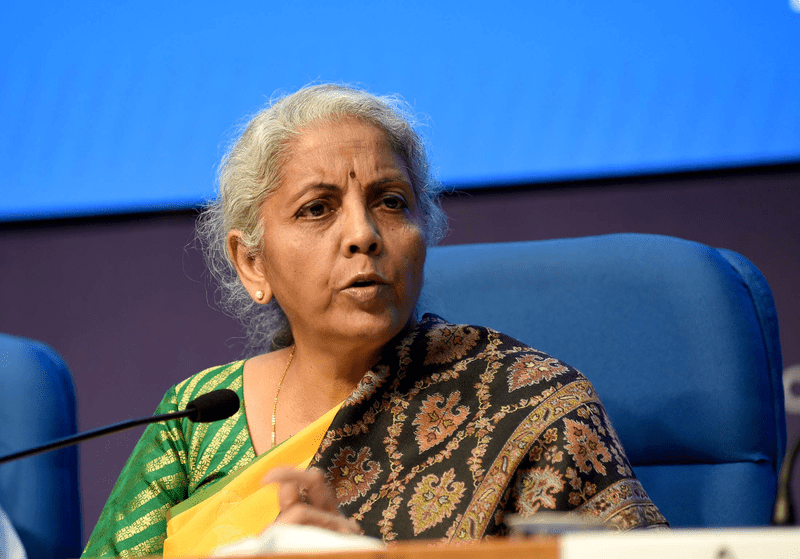

New Delhi/IBNS: The Indian business sector Wednesday extolled Finance Minister Nirmala Sitharaman for maintaining a continued focus on growth in terms of capital formation and job creation while reducing the tax burden on the salaried class in Union Budget 2023.

Union Budget 2023: SBI, PNB Housing, Kotak Investment Advisory react

New Delhi/IBNS: Finance Minister Nirmala Sitharaman on Wednesday (Feb 1, 2022) tabled the Union Budget for the Financial Year 2023-24 with a major focus on capital formation with the highest outlay ever outlay of Rs 2.40 lakh crore, about 9 times the outlay made in 2013-14. In a major relief to the middle class of the country, the Basic exemption limit has been raised to Rs 3 lakh from the existing Rs 2.5 under the new income tax regime in Budget 2023-24. Tax rebate under Section 87A has been hiked from Rs 5 lakh to Rs 7 lakh.

Mumbai/IBNS: Tata Sons Chairman N Chandrasekaran has praised the Union Budget for prioritizing growth “given the challenging macro backdrop of slowing global growth and tightened financial conditions.”