February 13, 2026 07:02 am (IST)

Union Budget 2016: Proposed benefits for pensioners

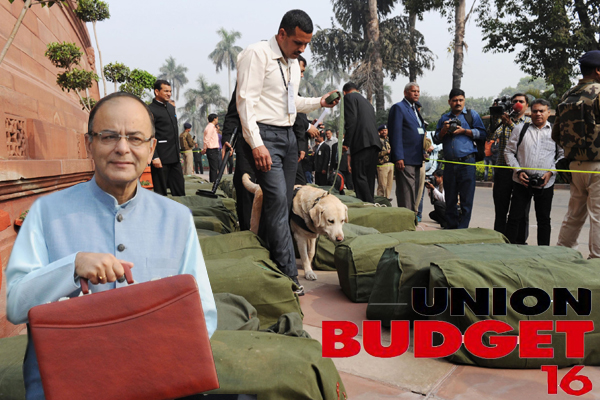

New Delhi, Feb 29 (IBNS) Union Finance Minister Arun Jaitley, while presenting the Union Budget 2016 on Monday, proposed several schemes for pensioners, including withdrawal up to 40% of the corpus at the time of retirement tax exempt in the case of National Pension Scheme(NPS).

He said pension schemes offer financial protection to senior citizens.

In case of superannuation funds and recognized provident funds, including EPF, the same norm of 40% of corpus to be tax free will apply in respect of corpus created out of contributions made after April 1, 2016.

Further, the annuity fund which goes to the legal heir after the death of pensioner will not be taxable in all three cases.

He also proposed a monetary limit for contribution of employer in recognized Provident and Superannuation Fund of Rs. 1.5 lakh per annum for taking tax benefit.

He proposed to exempt from service tax, the Annuity services provided by the National Pension Scheme (NPS) and Services provided by EPFO to employees.

Also, he proposed to reduce service tax on single premium annuity (Insurance) policies from 3.5% to 1.4% of the premium paid in certain cases.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.

Support objective journalism for a small contribution.

Latest Headlines

HUL’s Q3 shock: 30% core profit drop sends shares reeling

Thu, Feb 12 2026

Lenskart rallies 11% as Q3 profit soars

Thu, Feb 12 2026

TCS, Honeywell join hands to enhance autonomous operations for buildings and industries with AI

Wed, Feb 11 2026

Capgemini teams up with Microsoft to power resilient, trusted digital transformation for clients with integrated sovereignty solutions

Wed, Feb 11 2026

Britannia shares jump 4% after Q3 results beat expectations!

Wed, Feb 11 2026

Govt opens BHEL OFS: 5% stake on sale – here’s what you need to know

Wed, Feb 11 2026