February 13, 2026 02:21 am (IST)

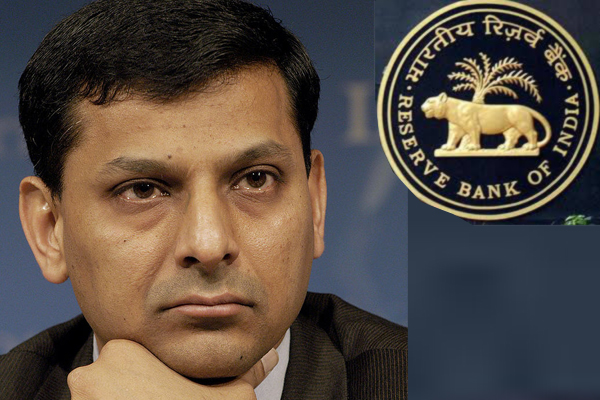

RBI keeps key rates on hold at 6.75 pc

Mumbai, Feb 2 (IBNS): With the annual general budget awaited end of the month, on expected lines the Reserve Bank of India (RBI) kept its policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.75 per cent, announced RBI Governor Raghuram G. Rajan on Tuesday.

Repo rate is the rate at which the central bank of a country (RBI) lends money to commercial banks in the event of any shortfall of funds.

RBI said it has decided to keep the cash reserve ratio (CRR) of scheduled banks unchanged at 4.0 per cent of net demand and time liability (NDTL).

It will continue to provide liquidity under overnight repos at 0.25 per cent of bank-wise NDTL at the LAF repo rate and liquidity under 14-day term repos as well as longer term repos of up to 0.75 per cent of NDTL of the banking system through auctions; and continue with daily variable rate repos and reverse repos to smooth liquidity.

Consequently, the reverse repo rate under the LAF will remain unchanged at 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 7.75 per cent.

In his policy statement, Rajan said that since the fifth bi-monthly statement of December 2015, global growth has slowed, with the ongoing weakening of activity in major emerging market economies (EMEs) outweighing the recovery in some advanced economies (AEs). World trade has remained subdued, held down by anaemic demand, new lows in commodity prices and currency realignments.

He pointed out that on the domestic front, economic activity lost momentum in Q3 of 2015-16, pulled down by slackening agricultural and industrial growth. In the first two months of Q3 of 2015-16, industrial activity slowed in relation to the preceding quarter. This mainly reflects weak investment demand with some deceleration of capital goods production.

While the number of stalled projects remain high, there are few new investment projects perhaps due to low capacity utilization.

The RBI's industrial outlook survey suggests a modest expansion of activity likely in Q4.

With prospects for the rabi harvest improving slowly, Rajan believes the near-term outlook for industrial activity may be constrained by adverse base effects in Q4 and still weak exports, although the pick-up in corporate profitability on the back of declining input costs may provide an offset. Some categories of services are likely to gain momentum on expectations of higher activity in coming months, though the aggregate state of activity remains muted. On balance, therefore, gross value added (GVA; a measure of output) growth for 2015-16 is kept unchanged at 7.4 per cent with a downside bias.

The policy report also mentioned that inflation has evolved closely along the trajectory set by the monetary policy stance. With unfavourable base effects on the ebb and benign prices of fruits and vegetables and crude oil, the January 2016 target of 6 per cent should be met. Going forward, under the assumption of a normal monsoon and the current level of international crude oil prices and exchange rates, inflation is expected to be inertial and be around 5 per cent by the end of fiscal 2016-17.

The policy report also highlighted that in keeping with the central government’s Start-up India initiative, RBI will take steps to ease doing business and contribute to an ecosystem that is conducive for growth of start-ups. These measures will create an enabling framework for receiving foreign venture capital, differing contractual structures embedded in investment instruments, deferring receipt of considerations for transfer of ownership, facilities for escrow arrangements and simplification of documentation and reporting procedures.

At the conclusion of the report, Governor Rajan said, "The Reserve Bank continues to be accommodative even as it leaves the policy rate unchanged in this review, while awaiting further data on the development of inflation. Structural reforms in the forthcoming Union Budget that boost growth while controlling spending will create more space for monetary policy to support growth, while also ensuring that inflation remains on the projected path of 5 per cent by the end of 2016-17."

The first bi-monthly monetary policy statement for 2016-17 will be announced on Tuesday, April 5, 2016.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.

Support objective journalism for a small contribution.

Latest Headlines

HUL’s Q3 shock: 30% core profit drop sends shares reeling

Thu, Feb 12 2026

Lenskart rallies 11% as Q3 profit soars

Thu, Feb 12 2026

TCS, Honeywell join hands to enhance autonomous operations for buildings and industries with AI

Wed, Feb 11 2026

Capgemini teams up with Microsoft to power resilient, trusted digital transformation for clients with integrated sovereignty solutions

Wed, Feb 11 2026

Britannia shares jump 4% after Q3 results beat expectations!

Wed, Feb 11 2026

Govt opens BHEL OFS: 5% stake on sale – here’s what you need to know

Wed, Feb 11 2026