Repo Rate

Repo Rate

RBI hikes repo rate by 40 bps to 4.4 pc

Mumbai: Reserve Bank of India (RBI) Wednesday raised key interest rate by 40 basis points to 4.40 per cent with immediate effect.

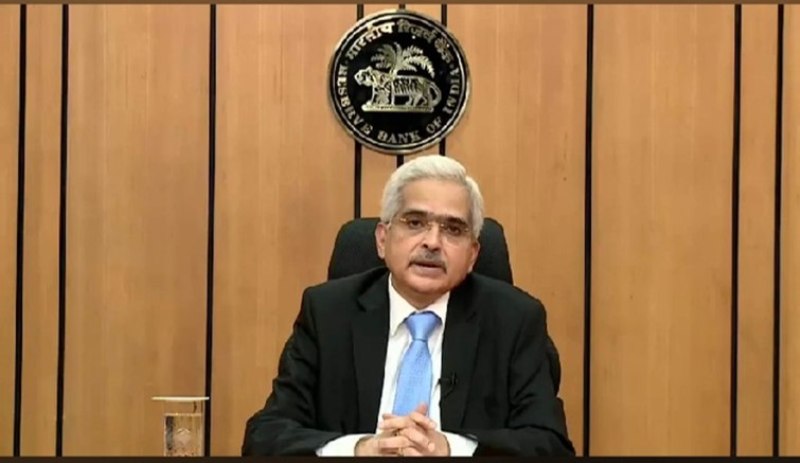

The monetary policy committee of the central bank took the decision in an off-cycle meeting held between May 2-4, RBI Governor Shaktikanta Das said.

One basis point is one hundredth of a percentage point.

The Cash Reserve Ratio or CRR is now at 4.5 percent. Cash Reserve Ratio (CRR) is the share of a bank’s total deposit that is mandated by the Reserve Bank of India (RBI) to be maintained with it as reserves in the form of liquid cash.

Statement by Shri Shaktikanta Das, RBI Governor https://t.co/cktaninqLF

— ReserveBankOfIndia (@RBI) May 4, 2022

The decision has been prompted by the rising inflation, geo-political tensions, high crude oil prices and shortage of commodities globally, which have affected the Indian economy.

“The decision today to raise repo rate may be seen as reversal of rate action of May 2020. In last month, we had set out a stance of withdrawal of accommodation. Today’s action need to be seen in line with that action,” Das said.

RBI's rate hike comes in the backdrop of retail inflation persistently remaining above the central bank’s comfort zone.

It also came ahead of the expected rate hike from the US Federal reserve.

Repo is the rate at which the central bank lends short-term funds to banks.

The Monetary Policy Committee has been on a prolonged accommodative stance to support growth amid economic slowdown and later further dented by Covid-19 pandemic.

Since February 2019, RBI has cut the repo rate by 250 basis points to support the economy's growth momentum.

“I would like to emphasise that the monetary policy action is aimed at containing inflation spike and re-anchoring inflation expectation,” Das said. "High inflation is known as detrimental to growth."

Das, however, stressed that the monetary stance remains accommodative and actions will remain calibrated.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.