February 10, 2026 06:24 pm (IST)

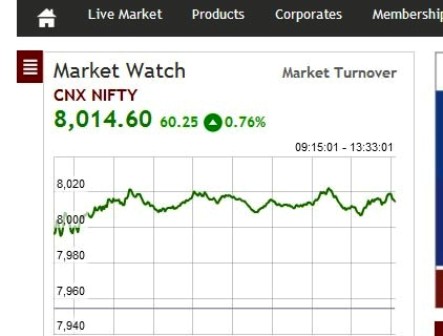

Nifty creates history, goes past 8,000

Mumbai, Sept 1 (IBNS) Boosted by latest GDP growth, Nifty on Monday created history by finally surging past 8,000 benchmark for the first time.

Indian stock market was on a roll for the past few sessions, where BSE and NSE indices, Sensex and Nifty respectively were creating new levels on a regular basis.

Banking on the latest GDP growth rate, Nifty today surged past 8,000 for the first time.

Data released on Friday showed that economic growth in April-June quarter hit 5.7 per cent, which is the highest in last two-and-a-half years for the quarter ending in June.

Records say, Nifty took just 78 sessions to hit the 8,000 from 7,000.

Nifty had hit 7,000 for the first time on May 12.

Not only Nifty, BSE index Sensex also recorded new high by getting past 26,800 mark today.

According to market analysts, the business-friendly policy of Narendra Modi-led NDA Govt. has paved the way for new small and medium investors who are pouring in funds in Indian markets.

Analysts say, Investors should keep investing. Even any big bad news will not have any major impact on the markets.

Vivek Gupta – Director Research, CapitalVia Global Research Limited, said: “Finally Nifty has crossed the level of 8000 today for which the markets were waiting for since long. It’s always best to go with the trend in the markets because if something you have to believe on or you got to stay with is the current trend of the market. If everyone thought that the market just had an election rally and it would not sustain and those who are still skeptical on current rise of the markets may have to change their way of thinking before it’s too late."

"During a bull market, even any big bad news doesn’t have any major impact on the markets.Investors those holding positions in market should hold their positions. In monthly charts Spot Nifty had a breakout from an ascending triangle when it crossed the levels of 6357.10 which as per technical rules have minimum targets of 8180 and the rise can continue. Investors should try to take maximum from these bull markets and trail their positions.

"Capital Good stocks like Bhel and steel sector big giant SAIL still may have lot to offer to investors. Investors should keep investing and better be stock specific in their selections and focus on stocks and sectors which have not caught up to the rally till now. Any correction right now should not be anticipated as end of the market rally, rather it should be anticipated as an opportunity to invest.”

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.

Support objective journalism for a small contribution.

Latest Headlines

White House clarifies India–US trade deal after Trump’s ‘zero tariff’ claim sparks buzz

Tue, Feb 10 2026

Deepinder Goyal exit shock fades as Zomato parent Eternal rallies 6% to multi-month high

Tue, Feb 10 2026

India steals the spotlight at BIOFACH 2026 as ‘Country Of The Year'

Tue, Feb 10 2026

Street can’t ignore this stock! Sansera Engineering rockets 12% after Q3 numbers drop

Tue, Feb 10 2026

India must push for energy independence amid global uncertainty: Vedanta chairman Anil Agarwal

Mon, Feb 09 2026

JK Tyre stock rallies on robust Q3 results, margins expand sharply

Mon, Feb 09 2026