India is likely to witness an office supply of 125 msf between 2017- 2019: Cushman & Wakefield

“Real estate in India is on the realm of change. With a positive global outlook and strengthening GDP, India is on the right track to becoming an economic force within the region," said Anshul Jain, Managing Director, India, Cushman & Wakefield.

"Backed by various policy reforms and government initiatives, the country today offers investors a more transparent and accountable business and investor-friendly environment. While the IT-BPM sector continues to be the major demand driving sector, its declining share is being replaced by demand from e-commerce, BFSI, Consulting Services, and healthcare sectors, among others to pave way for accelerated growth in the forecast period," he said.

According to the report, in the first half of 2017, Indian markets remain strong and are expected to see reasonable growth, despite the anticipated geo- political and economic disruptions

The banking, financial services and insurance (BFSI) sector was the biggest driver of leasing activity in Asia Pacific. Prominent financial institutions have secured major leases over 50,000 sf in India, Hong Kong and Australia.

New economy companies such as Uber, Grab and Alibaba have also been the most active tenants, accounting for nearly 20% of significant leases (over 50,000 sf) in the region.

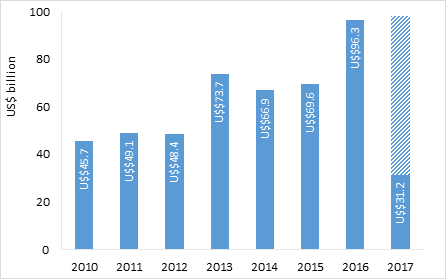

Cross-border investment volumes in the region in the first five months of 2017 reached USD31.2 billion, up by over a fifth compared to the same period last year to hit its highest ever.

Over 80% of capital have been ploughed into development sites so far this year, with Chinese developers setting new benchmarks and record prices in Hong Kong and Singapore.

“The Asia Pacific economies have been performing relatively well in 2017 and this positive momentum is expected to continue for the rest of the year, barring any unforeseen circumstances," said Siddhart Goel, Senior Director, India, Research.

"The real estate markets, which have benefited from these strong economic fundamentals will continue to prosper and register strong levels of activity and growth. The growth potential in the BFSI, technology and other industries bodes well for the office sector. We estimate that this could translate into a record annual average of over 100 msf of new office space requirements across the region through 2019. This comes at an opportune time as development surges. 2017 will be a record year, with nearly 150 million sf of new office projects slated for completion across the 27 major cities that we track, " he said.

According to the report, APAC region could reach a historic mark of 100 msf of office space leasing in 2017, with India contributing a significant annual average of 32-35 msf during forecast period

The report researc team expects India is also likely to witness an office supply of 125 msf between 2017- 2019.

More banks are planning to expand and grow their corporate banking and wealth management business. The BFSI sector is expected to account for 25%-30% of new leases in the next two to three years, the report cited.

Radical advances in e-commerce and mobile applications as well as breakthroughs in Artificial Intelligence (AI), robotics and automation will continue to reshape office growth drivers in Asia Pacific.

The ongoing technological changes and growth of the technology profession will continue to create demand for space, particularly in markets like Bengaluru, Manila, Hyderabad and Shenzhen.

The research firm believes strong land sales and sustained accommodating monetary conditions are expected to provide the necessary drivers to sustain capital flows. Chinese developers are expected to aggressively seek out development opportunities, particularly in markets where land values are supported by scarcity.

Asia Pacific is on track to remain the largest source of capital for global real estate investments, led by Chinese outbound investments and strong investor interest from Singapore and South Korean pension funds.

“The real estate investment outlook for the region is set for a strong 2017 as investors remain keen to deploy capital in the region," said Sigrid Zialcita, Managing Director – Asia Pacific Research. "India has already emerged as a front-runner for investors looking at emerging markets. We expect this positive sentiment to spill over into 2018.”

Image: Asia Pacific’s cross border investment volumes / Wikimapia

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.