Covid-liquidity measures

Covid-liquidity measures

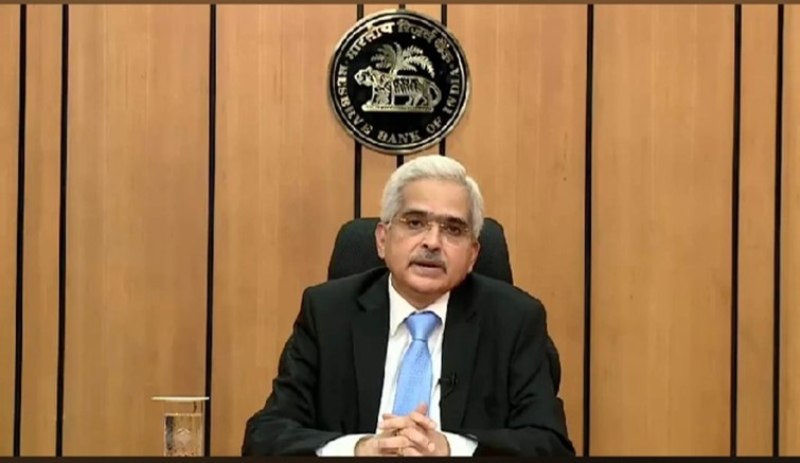

Covid-related liquidity measures were introduced with sunset date: RBI Governor

Covid-19-related liquidity measures announced by the central bank, excluding the interest rates, came with a sunset date, the Reserve Bank of India (RBI) Governor Shaktikanta Das has said.

Das said the central bank would draw out of the liquidity measures smoothly RBI will come out of the withdrawal of liquidity measures very smoothly, according to an ET report.

“We will ensure abundant liquidity to meet the requirements of the productive sectors of the economy. Rs 17 lakh crore liquidity support was provided,” he said at the CII National Council Meeting on Monday.

“RBI resisted all temptations of moving away from the accommodative stance to support growth. We foresaw inflation moderating going ahead,” Das said.

“Our focus was to reduce the cost of money. So, we cut the repo rate by 75 basis points. Soon we found the financial market to be freezing, so announced liquidity measures,” added Das.

Das said that the RBI took all possible measures to cope with the challenges emerging due to COVID and made sure that the market worked normally, be it the money market or the forex market, according the ET report.

Allaying the fears over current account deficit amid the Russia-Ukraine conflict, the Governor said that India is well prepared to finance it. "Our CAD was very low in the run-up to the war, our forex reserves are also very high at $622 billion," he said.

"We are closely watching the crude price swing and commodity cycles. We have to watch inflation dynamics. We are confident of dealing with any emerging challenge," Das added. "We don’t know today for how long crude oil will remain high. The situation today remains impossibly uncertain," said Das.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.