Kerala FM slams Centre for planning to implement 'calamity cess' on GST

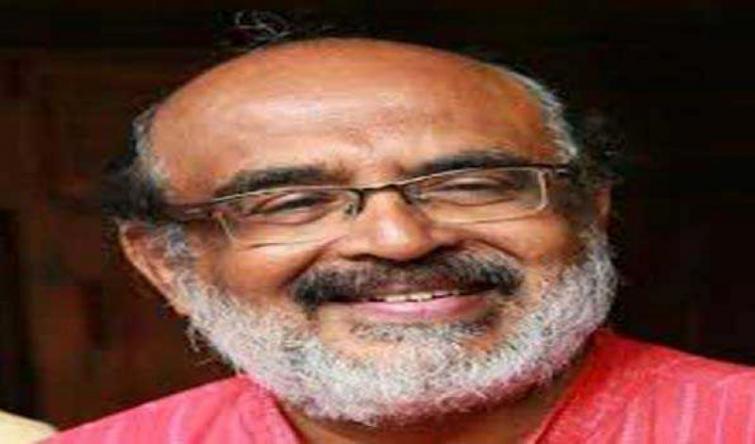

Thiruvananthapuram/UNI: Kerala Finance Minister Dr Thomas Isaac, who proposed one per cent 'calamity cess' in the previous State Budget, on Saturday slammed the Centre for its plan to implement a 'calamity cess' on GST above five percent.

Opining that this is not the time to implement a cess in the country due to the lockdown crisis, the minister alleged that the Centre was setting a new precedence and ignoring the rights of the State Governments.

He expressed his displeasure while speaking to a news channel in this regard.

It may be noted that his proposal of one per cent calamity cess in the previous State Budget was put on hold later.

Stating that all these things will be raised in the next GST Council meeting, he said many of the Centre's decisions were unprecedented, which have not been implemented by the previous Union governments or the previous Finance Commissions.

Alleging that the Centre had purposely reduced the GST rates just before the elections, he said the Centre gave only 20 per cent of the GST Fund to the state.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.