Budget: Basic Custom Duties reduced on certain items

To encourage new investment and capacity addition in the chemicals and petrochemicals sector, basic customs duty has been reduced.

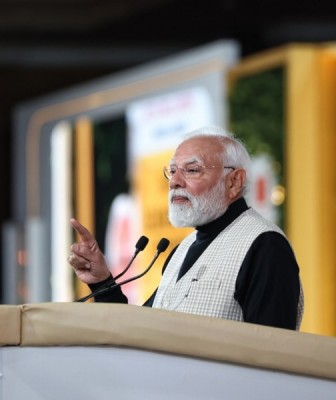

This was announced by Union Finance Minister Arun Jaitley while making his maiden budget speech in Lok Sabha on Thursday.

Jaitley said that steps have been taken to boost domestic production of electronic items and reduce our dependence on imports.

Colour picture tubes have been exempted from basic customs duty to make cathode ray TVs cheaper and more affordable to weaker sections.

To encourage production of LCD and LED TVs below 19 inches in India, basic customs duty on LCD and LED TV panels of below 19 inches has been reduced from 10 percent to Nil.

"To give an impetus to industry, the finance Minister said that the basic customs duty on imported flat-rolled products of stainless steel increased from 5 percent to 7.5 percent, Concessional basic customs duty of 5 percent extended to machinery and equipment required for setting up of a project for solar energy production," Jaitley said.

The budget proposes reduction in the basic customs duty from 10 percent to 5 percent on forged steel rings, used in the manufacture of bearings of wind operated electricity generators.

Concessional basic customs duty of 5 percent has been proposed on machinery and equipment required for setting up of compressed biogas plants (Bio-CNG).

Basic customs duty on metallurgical coke has been increased from Nil to 2.5 percent in line with the duty on coking coal.

The budget proposes increase in duty free entitlement for import of trimmings, embellishments and other specified items from 3 percent to 5 percent of the value of their export for readymade garments.

Export duty on bauxite increased from 10 percent to 20 percent. For passenger facilitation, free baggage allowance has been increased from Rs.35,000 to Rs.45,000.

To incentivize expansion of processing capacity, excise duty on specified food processing and packaging machinery has been reduced from 10 percent to 6 percent.

Concessional excise duty of 2 percent without Cenvat benefit and 6 percent with Cenvat benefit on sports gloves and the excise duty has been increased from 12 percent to 16 percent on pan masala, from 50 percent to 55 percent on unmanufactured tobacco and from 60 percent to 70 percent on gutkha and chewing tobacco and also levy0 an additional duty of excise at 5 percent on aerated waters containing added sugar.

To finance Clean Environment initiatives, the Clean Energy Cess has been increased from Rs.50 per tonne to Rs.100 per tonne.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.