RBI keeps repo rate steady at 5.5% as effects of past cuts unfold

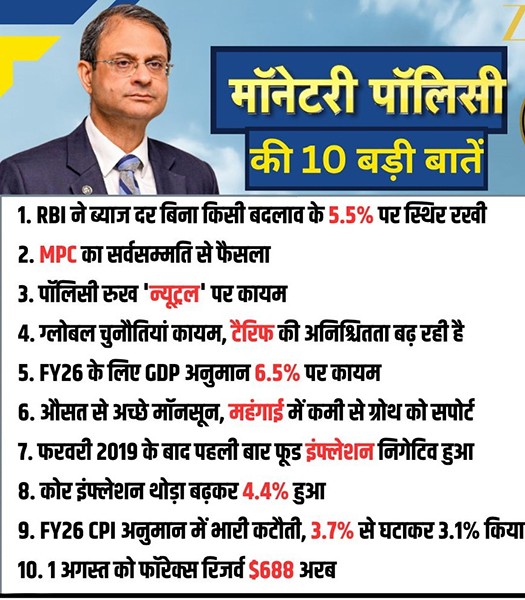

Mumbai: Reserve Bank of India (RBI) Governor Sanjay Malhotra on Wednesday said the Central bank’s Monetary Policy Committee (MPC) has decided to hold the repo rate at 5.5% in its August review, opting for a wait-and-watch approach as the full impact of previous rate cuts continues to play out.

For loan borrowers, the decision means no additional relief on EMIs for now.

The RBI-led MPC has already lowered the repo rate by 100 basis points (1%) so far this year, but the transmission into lending rates has been slower than expected.

Officials expect monthly loan instalments to come down further in the coming months as the rate cuts work their way through the system.

x.com/SmalhotraRBI

x.com/SmalhotraRBI

“The coordinated use of various tools available to us has helped accelerate monetary policy transmission in the current easing cycle. The Monetary Policy Committee met on the fourth, fifth and sixth of August to deliberate and decide on the policy repo rate.

The RBI held rates steady as expected and maintained its policy stance at "neutral", following a surprise 50-basis point cut in June.

— Sanjay Malhotra RBI 🇮🇳 (@SmalhotraRBI) August 6, 2025

Global trade challenges continue to linger but prospects for the Indian economy remain "bright", RBI Governor Sanjay Malhotra said in his…

"After a detailed assessment of the evolving macroeconomic and financial developments and outlook, the MPC voted unanimously to keep the policy repo rate under the liquidity adjustment facility unchanged at 5.5%,” Malhotra said.

He said monetary policy transmission is continuing, adding that the impact of the 100 basis points rate cut since February 2025 on the broader economy is still unfolding.

"On balance, the current macroeconomic conditions, outlook and the uncertainties call for continuation of the policy repo rate of 5.5% and wait for further transmission of the front-loaded rate cut to the credit markets and to the broader economy,” he stated.

The central bank’s policy comes amid fresh global concerns. US President Donald Trump has announced a 25% tariff on Indian exports, threatening to hike it “very substantially” within 24 hours if India does not halt oil imports from Russia.

Trump administration officials have accused New Delhi of “financing” Russia’s war against Ukraine by continuing its energy trade, marking a fresh source of geopolitical pressure that could weigh on India’s macroeconomic environment.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.