RBI | COVID19

RBI | COVID19

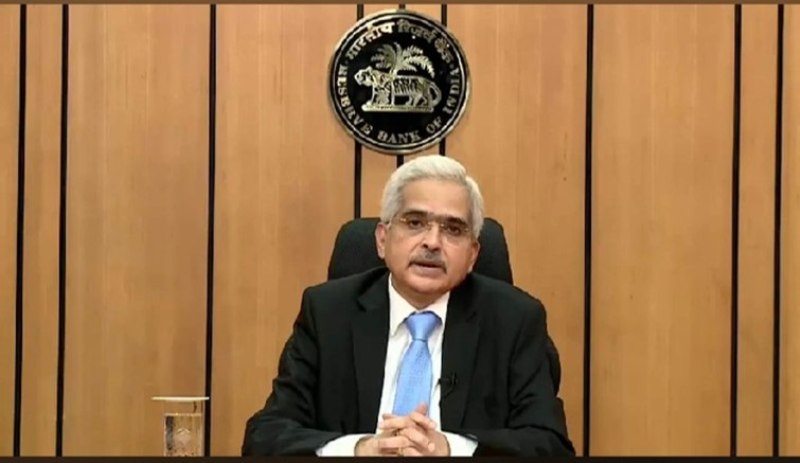

RBI Guv Shaktikanta Das asks pvt banks to strengthen their balance sheets

Mumbai/IBNS: RBI Governor Shaktikanta Das in a meeting with the MD & CEOs of some private sector banks on Tuesday through video conference asked them to continue focussing on efforts to further strengthen their balance sheets proactively.

"In his opening remarks, the Governor recognised the crucial role played by the private sector banks as important stakeholders in the Indian banking sector. He impressed upon the banks to quickly and swiftly implement the measures announced by RBI on May 5, 2021, in right earnest," RBI said in its statement.

The meeting was attended by Deputy Governors M. K. Jain, M. Rajeshwar Rao, Michael D. Patra, and T. Rabi Sankar.

Das advised the banks to ensure continuity in the provision of financial services, including credit facilities, to individuals and businesses in the face of the challenges brought on by the pandemic.

He also discussed with the private banks credit flows to small borrowers and micro, small and medium enterprises (MSMEs) and progress in the implementation of COVID Resolution Framework 1.0, announced in August 2020.

Das also advised the banks to ensure continuity in the provision of various financial services including credit facilities to individuals and businesses in the face of challenges brought on by the pandemic.

The governor also spoke to banks on the question of monetary policy transmission and the liquidity scenario.

The monetary policy committee has slashed rates by 250 basis points (bps) from February 2019 to back growth.

One bps is 1/100 of a percentage point.

On May 5, the RBI governor had announced several measures to tackle the second wave of the COVID-19 on banks and financial institutions as also their borrowers which included a term liquidity facility of Rs 50,000 crore for strengthening up emergency health services, a new resolution framework for COVID-related stressed assets, and for the state governments a relaxation in the overdraft facility.

The RBI also stepped in to rescue the small business owners with loans up to Rs 25 crore by allowing the lenders to restructure their debts.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.