RBI cuts repo rate of 40 basis points to 4 pc, term loan moratorium extended

Mumbai: The Reserve Bank of India on Friday announced a cut in the repo rate of 40 basis points to bring it down to 4 percent.

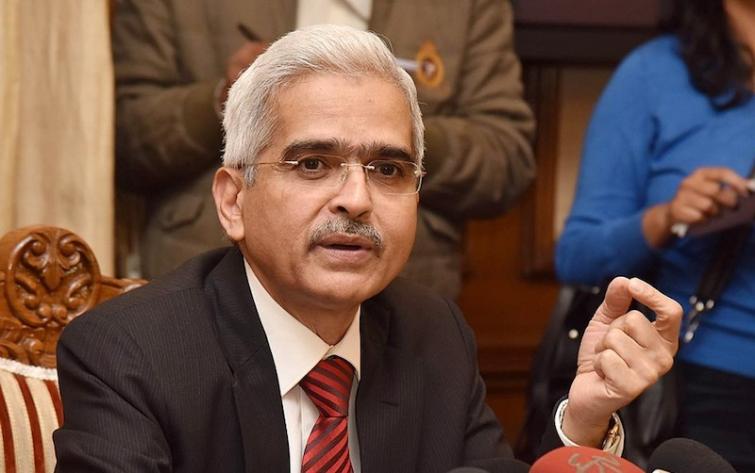

RBI governor Shaktikanta Das said: "After extensive discussions, the MPC [monetary policy committee] voted unanimously for a reduction in the policy repo rate and for maintaining the accommodative stance of monetary policy as long as necessary to revive growth, mitigate the impact of COVID-19, while ensuring that inflation remains within the target."

"On the quantum of reduction, the MPC voted with a 5-1 majority to reduce the policy rate by 40 basis points from 4.4 per cent to 4.0 per cent. Consequently, the Marginal Standing Facility (MSF) rate and the Bank rate stand reduced to 4.25% from 4.65%. The reverse repo rate stands reduced to 3.35% from 3.75%.

Earlier in March, the RBI had slashed the repo rate by 75 bps.

The Reserve Bank of India (RBI) has also extended the loan moratorium allowing the banks to defer EMI payments by another three months till August.

RBI Governor Shaktikanta Das addressed the media for the third time in three months to announce Covid-19 relief measures.

The decision of the MPC to reduce the policy repo rate and maintain the accommodative stance of monetary policy provides the opportunity for the RBI to announce certain additional measures against the backdrop of a deteriorating outlook for economic activity.

These policy actions complement and strengthen each other in intent and reach. The measures being announced today can be broadly delineated under four categories:

(A) measures to improve the functioning of markets and market participants;

(B) measures to support exports and imports;

(C) efforts to further ease financial stress caused by COVID-19 disruptions by providing relief on debt servicing and improving access to working capital; and

(D) steps to ease financial constraints faced by state governments.

Term loand moratorium extended till Aug 31:

The RBI had earlier, on two separate occasions (March 27 and April 17, 2020), announced certain regulatory measures pertaining to (a) granting of 3 months moratorium on term loan installments; (b) deferment of interest for 3 months on working capital facilities; (c) easing of working capital financing requirements by reducing margins or reassessment of working capital cycle; (d) exemption from being classified as ‘defaulter’ in supervisory reporting and reporting to credit information companies; (e) extension of resolution timelines for stressed assets; and (f) asset classification standstill by excluding the moratorium period of 3 months, etc. by lending institutions.

In view of the extension of the lockdown and continuing disruptions on account of COVID-19, the above measures are being extended by another three months from June 1, 2020 till August 31, 2020 taking the total period of applicability of the measures to six months (i.e. from March 1, 2020 to August 31, 2020).

The lending institutions are being permitted to restore the margins for working capital to their original levels by March 31, 2021. Similarly, the measures pertaining to reassessment of working capital cycle are being extended up to March 31, 2021.

REACTIONS:

Padmaja Chunduru, MD & CEO of Indian Bank on RBI annoncement: “Moratorium extension is the need of the hour.We are extending moratorium to all borrowers across all segments. This will now continue upto august 2020 in accordance with RBI dispensation

"Conversion of interest on working capital loans for the moratorium period into FITL will give a breather to the borrowers. The time period for repayment of that component could have been longer than just 7 months. Increase in Group exposure limits will help big companies tide over hurdles in raising funds from market”.

Pankaj Sharma, President & Head – Corporate Planning & Strategy, Religare Finvest Limited, said: “It is a welcome step by the RBI. Reduction in repo rate by 40 bps to 4% will further complement the stimulus package announced by the government recently and expand much required liquidity in the system.

"Another 3 month extension on loan moratorium and permission to convert accrued interest on the moratorium into a funded interest term loan to be paid during the tenure of the loan, will ease the pressure on the lending entities, especially NBFCs. Allowing restructuring of loans till Mar’21 without downgrade of asset classification would have further helped ease situation for both borrowers and NBFCs/banks."

"We are hopeful that the RBI will address this issue soon. With ongoing collapse in both urban and rural demand, we believe that the decision of the MPC would create favorable recovery conditions for the economy. The accommodative policy maintained by the RBI is also encouraging as the central bank has indicated its willingness to go for further easing, if the situation so warrants.”

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.