Repo Rate

Repo Rate

RBI cuts repo rate by 25 basis points to 6 percent after MPC meeting

Mumbai/IBNS: The Reserve Bank of India (RBI) on Wednesday reduced the key lending rate or repo rate by 25 basis points to 6 percent in a bid to support the demand in the market.

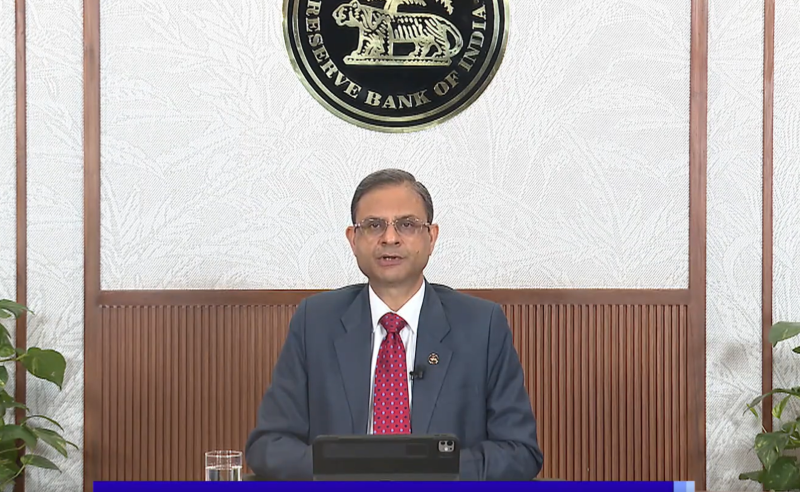

The rate cut was announced by RBI Governor Sanjay Malhotra after the central bank's Monetary Policy Committee (MPC) meeting which was conducted from April 7 to 9.

"After a detailed assessment of the evolving macroeconomic and financial conditions and outlook, the MPC voted unanimously to reduce the policy repo rate by 25 basis points to 6% with immediate effect," Malhotra said in his press briefing.

Monetary Policy Statement by Shri Sanjay Malhotra, RBI Governor- April 09, 2025, 10 am https://t.co/0OCWkvfgc3

— ReserveBankOfIndia (@RBI) April 9, 2025

This is the second repo rate cut in a row after the RBI reduced the lending rate by 25 basis points in February this year.

The repo rate cut has been announced amid the falling of inflation to below 4 percent and growing concerns over the economic growth which has slowed down.

Malhotra mentioned in his address that the RBI is "accomodative" as opposed to the bank's previous "neutral" stance.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.