Jio-Allianz

Jio-Allianz

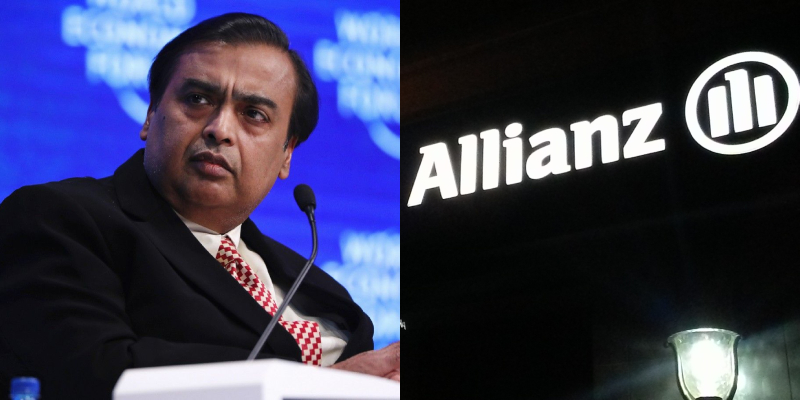

Mukesh Ambani's Jio Financial Services in talks with Allianz for insurance joint ventures in India post plans to exit Bajaj: Report

Mumbai/IBNS: Jio Financial Services Ltd., led by billionaire Mukesh Ambani, has been in discussions with Allianz SE to form a new insurance partnership in India, Bloomberg reported, citing sources familiar with the matter.

German insurer Allianz is reportedly looking to exit its current joint ventures in the country as part of this potential new collaboration.

The talks involve creating both a general insurance company and a life insurance company in India, though the discussions are still in the early stages and may not result in a finalized deal, the sources cautioned, given the private nature of the information, according to the Bloomberg report.

Allianz has informed its current partner, Bajaj Finserv Ltd., that it is “actively considering an exit” from their existing partnerships, a statement from Bajaj confirmed on Tuesday (Oct. 22).

Despite the shift, Allianz emphasized its continued commitment to the Indian insurance market.

Sources told Bloomberg that the split stems from differing views on the partnership's strategic direction.

In response to the reports, a Jio Financial spokesperson refrained from commenting on market speculation, stating, “If and when there are any material developments regarding the company, we will fulfill our disclosure obligations as we have always done.”

Allianz similarly declined to comment on market rumours.

Jio Financial, which is led by experienced banker K.V. Kamath, already operates a shadow banking business and an insurance brokerage.

It has also partnered with BlackRock Inc. to establish an asset management venture.

Expanding into insurance would be a strategic step in Jio Financial’s ambition to become a comprehensive financial services powerhouse.

India's insurance sector shows promising growth potential, as the country’s insurance penetration rate—measured as the ratio of premiums to GDP—is significantly lower than that of countries like South Africa and Canada, according to data from the insurance regulator.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.