India and Kazakhstan sign Protocol to amend the Double Taxation Avoidance Convention (DTAC)

Salient features of the Protocol are as under:

(i) The Protocol provides internationally accepted standards for effective exchange of information on tax matters. Further, the information received from Kazakhstan for tax purposes can be shared with other law enforcement agencies with authorisation of the competent authority of Kazakhstan and vice versa.

(ii) The Protocol inserts a Limitation of Benefits Article, to provide a main purpose test to prevent misuse of the DTAC and to allow application of domestic law and measures against tax avoidance or evasion.

(iii) The Protocol inserts specific provisions to facilitate relieving of economic double taxation in transfer pricing cases. This is a taxpayer friendly measure and is in line with India’s commitment under Base Erosion and Profit Shifting (BEPS) Action Plan to meet the minimum standard of providing Mutual Agreement Procedure (MAP) access in transfer pricing cases.

(iv) The Protocol inserts service PE provisions with a threshold and also provides that the profits to be attributed to PE will be determined on the basis of apportionment of total profits of the enterprise.

(v) The Protocol replaces existing Article on Assistance in Collection of Taxes with a new Article to align it with international standards.

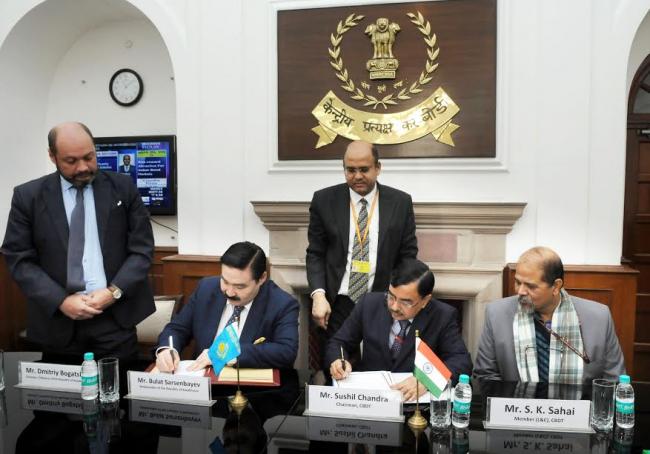

Image caption: The Chairman, CBDT, Sushil Chandra and the Ambassador of the Republic of Kazakhstan to India, Mr. Bulat Sarsenbayev signing a Protocol to amend the existing Double Taxation Avoidance Convention (DTAC) between India and Kazakhstan, in New Delhi on January 06, 2017.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.