Corporate India Risk Index 2021

Corporate India Risk Index 2021

ICICI Lombard’s 2nd edition of Corporate India Risk Index witnesses a 9 pc jump

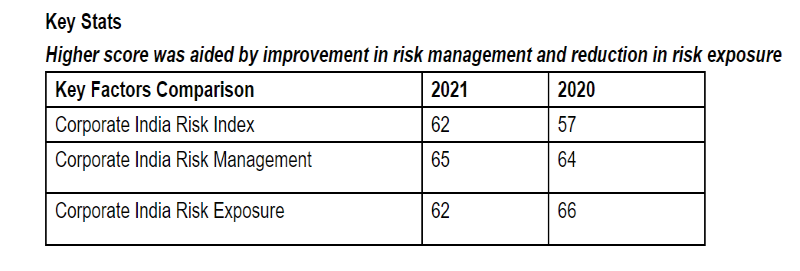

The Corporate India Risk Index 2021 score has gone up to 62 from 57 in 2020, representing "optimized risk handling" with scope for further improvement.

These findings are a part of the second edition of ICICI Lombard’s Corporate India Risk Index (CIRI). The company has released the study in continued collaboration with Frost and Sullivan, a leading global management consulting firm.

CIRI is a first-of-its-kind risk measurement tool to gauge the level of a company’s risk exposure and preparedness, ICICI Lombard GIC said in a press release.

A higher score signifies better risk management, enabling companies to adopt effective risk management practices.

The framework comprises 32 risk elements across six dimensions. This year, the study covered 220 companies across 20 sectors, in comparison to 150 companies across 15 sectors in 2020.

The five new sectors include Agriculture & Food processing, Bio-tech & Life Science, Aerospace & Defence, Media & Gaming, and Educational Skill Development.

"The findings of the 2021 edition of the Index show that Pharmaceuticals, Telecom & Communication, and FMCG are among the 10 sectors that demonstrated superior risk handling," the release stated.

However, sectors like IT/ITES and Education & Skill Development are at the border of being in the “significant gaps in risk handling” bucket, it added.

Also, while corporates have fared better on operational and natural hazard risks, they need to improve management of market, economic, technology, crime and security-related risks.

As India copes with pandemic and emphasises better risk management, the traditional sectors are leading the newer ones.

Emerging industries, on the other hand, thrive when it comes to managing technological risks and adaptability in the market and economy.

"The highest improvement was witnessed in the Transportation & Logistics sector, which has secured a score of 69, up from 47 in 2020. The sector bounced back post-pandemic owing to new strategic initiatives and business models. Similarly, the Chemicals and Petrochemicals sector improved from 55 to 69," the study noted.

The rebound was driven by the changes made in the operational and financial risk management practices which yielded rich returns in 2021, well supported by their investments in effective processes and global certifications.

Commenting on the launch, ICICI Lombard MD & CEO Bhargav Dasgupta said, “ICICI Lombard’s Corporate India Risk Index intends to give companies access to an extensive and comprehensive range of quantifiable metric of risk management.

"The improvement in India Inc.’s score of nearly 9 percent are a reflection of better risk management across 200 corporates from 20 industries. With the continued focus on risk agenda in the boardroom, we have the potential to move from ‘Optimal’ to ‘Superior Risk Handling’ on the Index.”

Lee Kong Chian Professor of Marketing at Singapore Management, University Nirmalya Kumar said, “ICICI Lombard’s Corporate India Risk Index is an important contribution in identifying and measuring risks across various sectors. The practical application of this risk metric helps firms understand the level of risk their business is exposed to, assess their level of preparedness, and take steps to improve their risk management strategies accordingly.”

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.