Future Generali India Insurance ties up with UCO Bank

Through the tie-up, Future Generali will offer its health & PA, motor, travel, home and rural insurance products across 3050 branches of UCO bank.

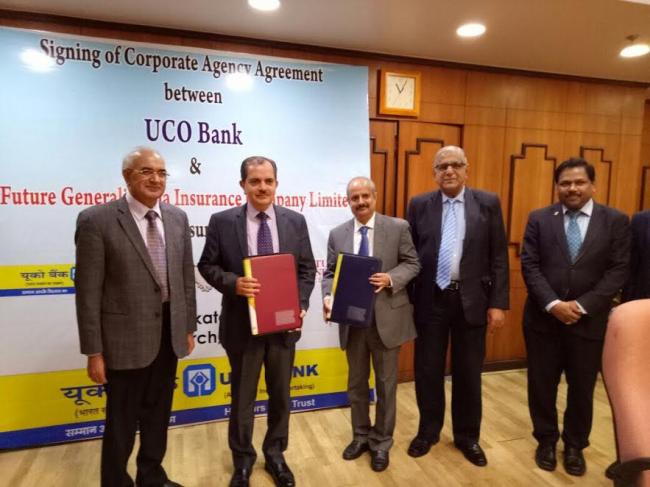

K.G. Krishnamoorthy Rao, MD and CEO, Future Generali India Insurance Company Limited exchanged the Corporate Agency Agreement with Ravi Krishan Takkar, MD & CEO, UCO Bank on Wednesday.

K.G. Krishnamoorthy Rao, MD and CEO, Future Generali India Insurance Company Limited commented on the occasion, “Bancassurance is a key medium to reach out to the masses. Customers can directly walk into the bank and seek advice from executives they have been trusting over the years. We aim to offer insurance products to bank’s customers and enter new markets. The bank is headquartered in Kolkata and through this tie-up we aim to widen our customer outreach to Eastern India.”

Anurag Sinha, Senior VP – Bancassurance and Zonal Manager – West, Future Generali India Insurance Company Limited said, “We are motivated to partner with UCO Bank and look forward to the journey to achieve our objective of servicing customers in both urban and rural areas. Through this association, we expect to cover 26 million customers of the bank and abide by our aim of offering the best products to the customers."

Currently Bancassurance accounts for 5% of Future Generali’s total business. Recently, the company tied-up with Bank of Maharashtra. Additionally, it has tie-ups with over 100 banks across the country. Strengthening business across all the partner banks coupled with the new association of UCO Bank, the company aims to achieve a growth of 80% by end of FY18.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.