Cabinet approves the establishment of the National Anti-profiteering Authority under GST

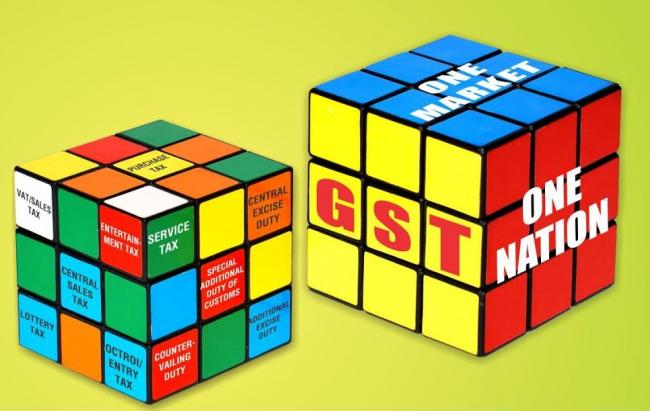

New Delhi, Nov 16 (IBNS): Union Cabinet chaired by Prime Minister Narendra Modi has given its approval for the creation of the posts of Chairman and Technical Members of the National Anti-profiteering Authority (NAA) under GST, following up immediately on yesterday's sharp reduction in the GST rates of a large number of items of mass consumption.

This paves the way for the immediate establishment of this apex body, which is mandated to ensure that the benefits of the reduction in GST rates on goods or services are passed on to the ultimate consumers by way of a reduction in prices, read a government statement.

The establishment of the NAA, to be headed by a senior officer of the level of Secretary to the Government of India with four Technical Members from the Centre and/or the States, is one more measure aimed at reassuring consumers that Government is fully committed to take all possible steps to ensure the benefits of implementation of GST in terms of lower prices of the goods and services reach them.

It may be recalled that effective from midnight of 14th November, 2017 the GST rate has been slashed from 28% to 18% on goods falling under 178 headings. There are now only 50 items which attract the GST rate of 28%. Likewise, a large number of items have witnessed a reduction in GST rates from 18% to 12% and so on and some goods have been completely exempt from GST.

The "anti-profiteering" measures enshrined in the GST law provide an institutional mechanism to ensure that the full benefits of input tax credits and reduced GST rates on supply of goods or services flow to the consumers. This institutional framework comprises the NAA, a Standing Committee, Screening Committees in every State and the Directorate General of Safeguards in the Central Board of Excise & Customs (CBEC).

Affected consumers who feel the benefit of commensurate reduction in prices is not being passed on when they purchase any goods or services may apply for relief to the Screening Committee in the particular State. However, in case the incident of profiteering relates to an item of mass impact with 'All India' ramification, the application may be directly made to the Standing Committee. After forming a prima facie view that there is an element of profiteering, the Standing Committee shall refer the matter for detailed investigation to the Director General of Safeguards, CBEC, which shall report its findings to the NAA.

In the event the NAA confirms there is a necessity to apply anti-profiteering measures, it has the authority to order the supplier / business concerned to reduce its prices or return the undue benefit availed by it along with interest to the recipient of the goods or services. If the undue benefit cannot be passed on to the recipient, it can be ordered to be deposited in the Consumer Welfare Fund. In extreme cases, the NAA can impose a penalty on the defaulting business entity and even order the cancellation of its registration under GST.

The constitution of the NAA shall bolster confidence of consumers as they reap the benefits of the recent reduction in GST rates, in particular, and of GST, in general.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.