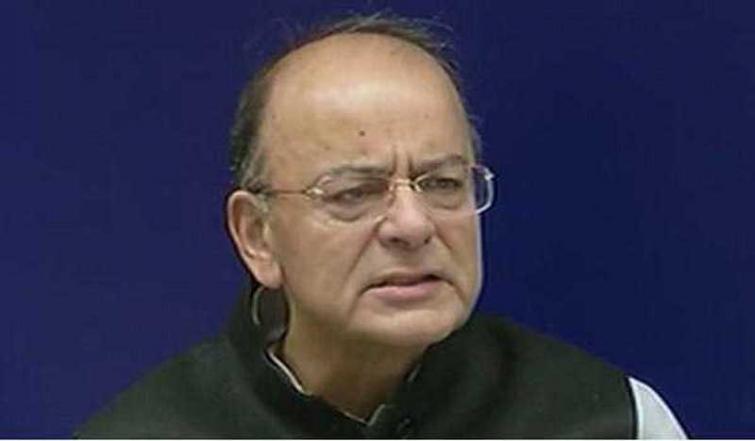

Banks are no more puppets of any govt: Arun Jaitley

New Delhi, Feb 28 (UNI) Union Finance Minister Arun Jaitley said on Thursday that the UPA regime was a great learning experience and taking a cue from them, they have provided public sector banks such a competitive environment and easy norms that they are no more puppets of any government.

“Earlier regime was a great learning experience. We announce easy norms for banks functioning. Public sector banks are now working in competitive environment and are no more puppets like any public sector undertakings,” Jaitley said during the release of Ease Reforms report on Public sector banks, organised by the Indian Banks’ Associations here.

He said the Government has put the system in place and has brought down the number of mindsets who got to live in violations or perpetuity.

“I think message has gone home loud and clear that people had to break away from what was normal and live with new normal… In the banking sector, the whole idea was that if you don’t pay a bank, you get away with it and then it's a banker's headache. Get money from banks and manufacture your own equity from that. This can’t be the new normal,” the Minister added.

On the Insolvency and Bankruptcy Code (IBC), Jaitley said the new law has really transformed the sector as close to Rs 2.85 lakh crore deposited back in the banks from creditors.

The new law has brought all perpetrators under its purview and the great example of it was the Punjab National Bank that has really suffered both in terms of finance and reputation.

But the lendor has put back Rs 14,000 crore in just nine months, setting aside its bad assets and rapidly transforming itself into a best performing bank. The bank even posted a profit in the last quarter of this financial year.

He said competitiveness has been added to the system. The curve of Non-Profit Assets (NPA) has come down. In the first instance, the curve has gone up due to truthful closure and there was no hiding under carpet.

“With these easy norms, the bankers have reported a balanced health, better growth and high level of professionalism. Besides, now the banks can sleep well.”

He added that the success of the IBC was based on the fact that the government was kept at an arm's length from the institutions, decisions were taken by their boards only, with no interference of the government.

Department of Finance Service Secretary Rajeev Kumar said the EASE Index has made independent and objective measurement of each public sector bank on 140 metrics across 6 themes.

On the occasion, “e-bikray” portal -- a common landing platform for information & searching properties put-up for auction by the public lendors -- was also launched by Jaitley.

Image: UNI

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.