October inflation rate likely to exceed September’s 5.5%: RBI Governor

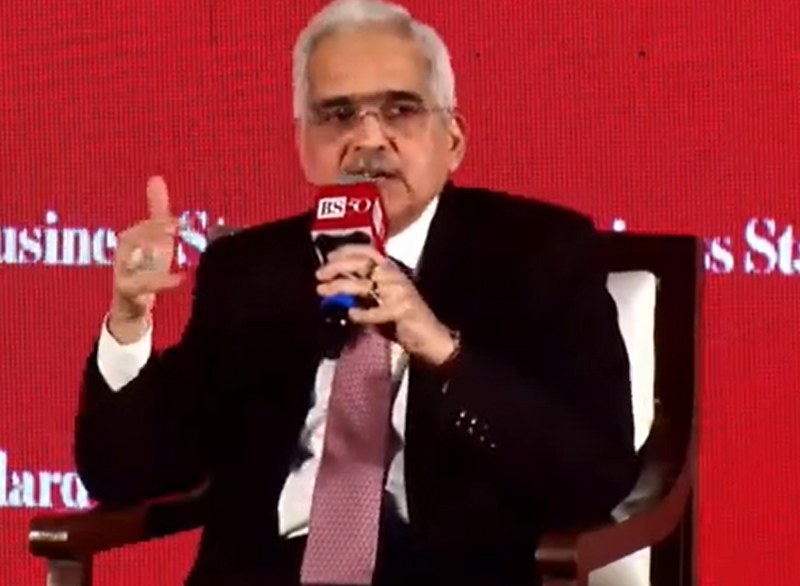

New Delhi: Reserve Bank of India (RBI) Governor Shaktikanta Das cautioned that October's inflation rate is expected to exceed the 5.5% recorded in September.

Speaking at the Business Standard BFSI Insight Summit on Wednesday, Das emphasized that the RBI stands ready to respond with “strength and agility,” comparing India’s economic resilience to a “tiger” amid shifting global conditions.

Inflation in India has seen recent volatility, primarily due to rising food costs. September's inflation rate was propelled by a 36% year-on-year surge in vegetable prices and a food inflation rate of 9.24%.

Despite these pressures, Das reaffirmed the RBI's commitment to financial stability.

Das highlighted two international events of interest to financial markets: the U.S. election results and fiscal policy updates from China.

“US elections can go either way until the end. Two things are very clear: overall India-US relations have become much stronger, and that will continue regardless of who wins,” he stated.

On India’s growth outlook, Das noted positive trends in GST e-way bills, toll collection, air passenger traffic, steel consumption, and cement sales, underscoring economic resilience.

However, indicators such as the Index of Industrial Production (IIP) and urban FMCG sales have shown some slowdown.

Das explained that the RBI closely monitors 70-80 high-frequency indicators, finding that “the positives outweigh the negatives” in India’s growth outlook.

The IMF forecasts a 7% growth rate, with the RBI projecting a slightly higher 7.2%.

Looking forward, Das warned of “significant upside risks to inflation” from global geopolitical tensions, fluctuating commodity prices, and climate impacts.

Since February 2023, the RBI has kept the repo rate steady at 6.5% to steer inflation toward the 4% target.

For FY25, the central bank projects CPI inflation at 4.5%, with quarterly estimates at 4.4% for Q2, 4.7% for Q3, and 4.3% for Q4, assuming a normal monsoon.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.