RBI

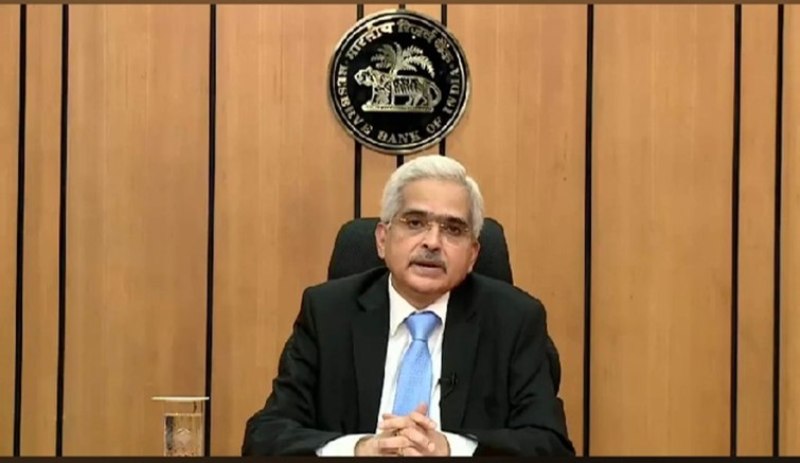

RBI RBI can consider idea of bad bank: Governor Shaktikanta Das

New Delhi/UNI: The Reserve Bank of India would consider the idea of a bad bank if there is any such proposal, Governor Shaktikanta Das said on Saturday.

“If there is a proposal to set up a bad bank, the RBI will look at it," Das said during a Q&A session at the Nani Palkhivala Memorial lecture he delivered at a virtual event.

"We have regulatory guidelines for ARCs (asset reconstruction companies). We are open to look at any proposal to set up a bad bank. If any proposal comes, we are open to examine it," he said.

His statement comes days ahead of the Union Budget Finance Minister Nirmala Sitharaman will present on February 1.

A bad bank is a bank set up to buy the bad loans and other illiquid holdings of another financial institution.

Economic Affairs Secretary Tarun Bajaj last month said the government is exploring all options, including setting up of a bad bank, to improve the health of the country's banking sector.

Indian Banking Association and the industry chamber CII had submitted a proposal to set up a national level asset reconstruction company with the government infusing capital worth Rs 10,000 crore.

The idea of forming a 'bad bank' in India was initially floated in January 2017 when the Economic Survey of India suggested setting up a Public Sector Asset Rehabilitation Agency (PARA).

In 2018, the government proposed a five-pronged strategy under Project Sashakt to tackle stress in the banking sector.

Das also said the RBI would roll out measures on improving governance in banks and non-banks over the next few months.

He said greater RBI supervision is required to ensure quality of governance, as recent incidents have highlighted the role of promoter, shareholders and senior management in governance.

He also said the central bank would take any measures as may be required to support growth without compromising on financial stability.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.