Industries not happy at RBI's unchanged repo rate at 5.15%

Kolkata/UNI/IBNS: Tata Realty & Infrastructure Limited (TRIL) in a statement today expressed disappointed at RBI's monetary policy rate report that there is no change at repo rate which remains at 5.15%.

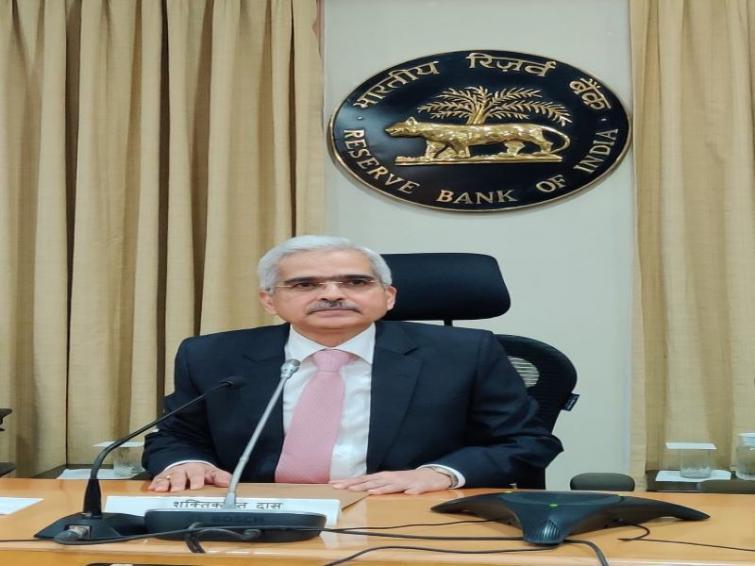

The Reserve Bank of India's six-member Monetary Policy Committee (MPC) unanimously kept the repo rate unchanged at 5.15 per cent on Thursday. Repo rate is the key interest rate at which the RBI lends short-term funds to commercial banks.

“This time, while the focus of the RBI remains to be on reviving the economy, we are disappointed to see no change in the policy rate which remains at 5.15 per cent," said Tata Realty & Infrastructure Limited's MD and CEO Sanjay Dutt.

"The anticipation was for a more liberal 25 bps rate cut and we hope that the RBI sees room for a generous rate cut in the system in the near future, especially with the GDP growth target for 2019-20 being revised downwards to 5 per cent," Mr Dutt maintained.

The real estate industry, in particular, has been facing some difficult times and with inventories piling up the need to push demand and encourage purchase is now more than ever. Enabling people to obtain loans at a lesser interest rate would certainly help in the long run, he opined.

The transmission of the benefits to home buyers brought upon by the earlier policy rate cuts also remains to be seen.

"Although the government is trying to boost the sector with initiatives like the Rs 25,000 crore fund, the current efforts might not be adequate. The government’s continued support is expected to ease liquidity pressures and in reviving the ailing sector,” Mr Dutt added.

Mr. Abheek Barua, Chief Economist, HDFC Bank stated, "The pause in the rate cycle comes as a surprise given the dismal growth for the second quarter of 2019-20 and the likely persistence of a slowdown. Clearly the RBI has responded to hardening headline inflation and rising inflation expectations of households. "

"This suggests two things. Any sustained increase in headline CPI inflation (whether or not it is primarily driven by supply shortages that the RBI itself acknowledges as transitory) above the median of the target range of 2 to 6 per cent will cause make the MPC anxious and translate into a pause," he noted.

"It also seems that the RBI wishes to see the lagged impact of its front-loaded 135 basis point cut in the policy rate along with some of the slew of fiscal measures plays out for future growth. We expect some tightening in bond yields in response to this surprise," ge stated.

" Given the paucity of loan demand, banks are likely to chase assets and the transmission process could gain traction. However the flight to safety and large risk premiums for risky borrowers will persist," he added.

Mr. Samir Jasuja, Founder and MD at PropEquity said, "Industry was expecting a rate cut as that would have somewhat provided a positive sentiment to the housing sector.Any positive news on borrowing interest rates would have provided the sector an upward trigger. The recent decision by the government on creating a stress fund of Rs 25,000 crore for stalled projects has provided some relief for delayed and stuck projects but to truly revive the demand, much more needs to be done by the government. Going ahead, we do expect a repo rate cut by RBI in the beginning of the new year as government looks to provide the right platform for housing growth.

However, Mohit Ralhan - CIO & Managing Partner of TIW Privaye Equity said, “Given the increase in inflation, RBI had a difficult choice. So, it has for now decided to maintain the status quo. The policy stance remains accommodative with RBI adopting a wait and watch approach. The onus is now on the banks to pass on the previous rate cuts to businesses and consumers.”

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.